Prime Minister Srettha Thavisin could not be clearer: “You must pay tax on earnings you make no matter how you make it.” He was describing the income department’s “information” that, from January 2024, it prepared to the tax foreign earnings on all people, Thai or foreign, who have actually lived each year in the nation for over 6 months. The department’s declaration particularly closed the loophole, under existing law, that anybody might leave the tax by postponing transfer of the funds up until a later tax year, for instance by holding it in overseas funds.

It is typically comprehended that the inbound Pheu Thai federal government need to raise mega-funds for its well-being policies, for instance the US$ 16 billion (560 billion Thai baht) wallet plan to pay 10,000 baht to all adult Thais as a regenerative financial relocation. Nevertheless, the policy has plainly surprised Thailand’s expat neighborhood who though they were tax-free unless formally operating in Thailand. Certainly, the previous federal government, led by basic Prayut Chan-o-cha, had actually marketed its long stay visas, specifically Elite, exactly on the premises that immigrants were primarily excused paying earnings tax here.

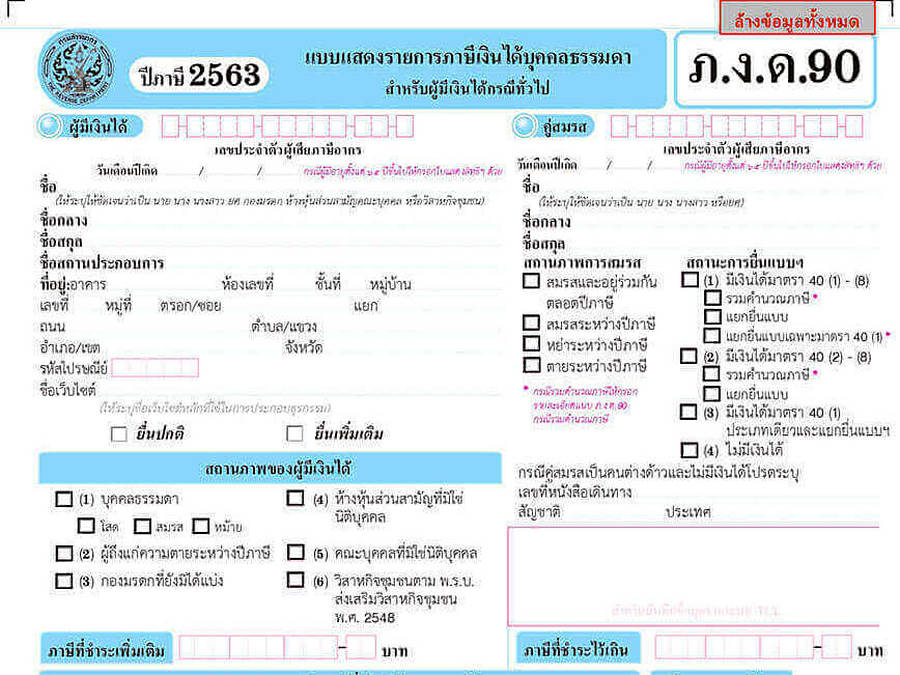

The very first grey location for expats is registration. Contrary to some reports, there will be no reduction of funds on arrival. The system at first will be self-registration with taxable expats remaining in Thailand longer than 180 days signing up online with the income authority to get a TIN or Tax Recognition Number. Probably, there will be more assistance on this treatment in later statements. Naturally, the self-registration is supported by all the information of foreign deals which are now much easier to trace thanks to technological development. Rich expats are most likely to select a tax legal representative to fill out types on their behalf.

The next uncertainty for immigrants is the double tax arrangement (DTA) which exists in between 61 nations and Thailand. This indicates that some expats can take advantage of Thai tax relief by tax exemptions or tax credits where particular conditions are satisfied. The most regularly example is pension earnings (state or work) which is taxed in the source nation. Not to point out that the earnings may well be taxed in the house nation despite the fact that there is no official arrangement with Thailand. This entire location requires main information to prevent an administrative headache and gross disillusionment.

The current earnings tax guidelines will not use to an immigrant living in Thailand for less than 180 days in a year. If she or he moved, state, 4 million baht to Thailand to acquire a condo system, individual earnings tax as just recently specified would not run. However an expat, living here for the majority of the year, might discover a comparable transfer may get tangled in the income internet. Lots of other examples, beyond home purchases and sales, might be priced quote to highlight the devil will remain in the information. What is definitely clear is that the Thai earnings tax arms are expanding beyond abundant Thais making money abroad (or in your home) and concealing it in overseas accounts or foreign banks.

For the previous 4 years, immigrants (unless working here with work authorizations) have actually primarily been excused disturbance by the income department. It has actually been a discretion not a right. Some Thais have actually likewise been consisted of in this classification, for instance abroad employees sending percentages back to their households in Thailand. There is currently much talk in expat circles about stopping Thailand. What is needed is a policy declaration by the income or Cabinet authorities even whilst acknowledging that a complicated scenario remains in a trial duration and might stay so for months. Often silence is the very best policy. Not in this case.