Issues about the Thai Earnings’s objective to tax foreign earnings from January 2024 has actually developed a brand-new market for Thailand’s Long Term Citizen visa. That’s since those who acquire the ten years LTR are excused from paying individual earnings tax on foreign possessions or profits. The brand-new guidelines use to all native and foreign citizens of Thailand who invest 6 months or more here in a year.

The Board of Financial investment, which manages the LTR, states about 3,000 such visas were released considering that the launch in 2022, however the promotion surrounding the brand-new tax policy has actually seen a 14 percent increase in applications. LTR has numerous classifications of application consisting of rich pensioners, abundant international residents, entrepreneurs and business owners. The one-time application charge is 50,000 baht (US$ 1,400) however it is likewise needed to invest considerably in Thailand, or when it comes to retired people, to have yearly earnings of a minimum of US$ 80,000.

LTR policies are complicated. There is required medical insurance coverage to be purchased although entrepreneurs are entitled to have a work license without the normal terms of requiring to have Thai employees. David Myers, a tax specialist in Bangkok, stated, “LTR is beyond the monetary reach of many expats, however is showing popular with the abundant who wish to prevent the normal visa and earnings tax difficulties when investing abroad in foreign stock exchange, bonds or residential or commercial property.”

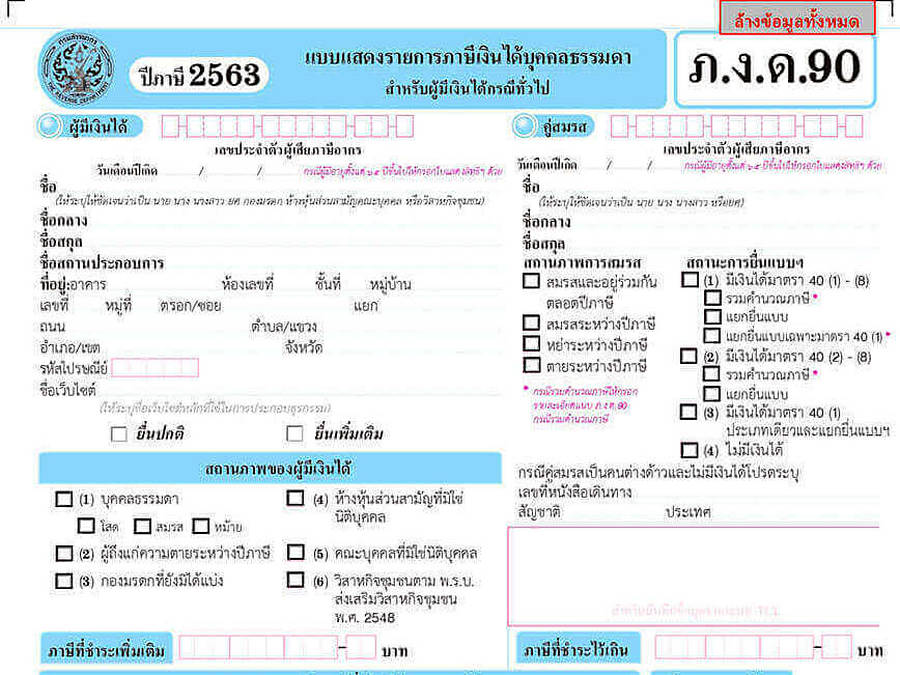

The brand-new tax policies are still unclear on numerous information, particularly position of foreign earnings such as pensions currently taxed before being sent out to Thailand. With just 2 weeks to precede execution, many professionals are presuming that registration with the Thai tax authority will be at first voluntary. “The objective is to take significant tax fiddlers who have actually taken advantage of main laxity in the past and not, I believe, common expats who are retired here or supporting Thai partners or households.” He included that he anticipated more information to percolate gradually over the next couple of months. “There is no rush as any tax for the year 2024 will not be due up until 2025 in any case.”