The hotel company in Thailand is continuously developing, and hoteliers have actually drawn up techniques to capitalize the growing tourist market.

Thai tourist is on track for another record-breaking year, with more than 35 million global arrivals anticipated in 2017 and 35 million projection for 2018.

However the Thai Hotels Association (THA) cautioned the hotel sector in significant locations like Bangkok, Phuket, Pattaya and Chiang Mai is oversupplied, while development in typical space rates across the country has actually slowed compared to a years back. As such, not every gamer can gain from flourishing tourist.

100 brand-new hotels

According to US-based STR International and Thai consultancy C9 Hotelworks, high need is increasing self-confidence in Thailand’s hotel sector, with 100 brand-new hotels and 21,600 spaces in the advancement pipeline– a lot of which will remain in Bangkok.

However difficulties lie ahead, specifically for transportation facilities to deal with the traveler increase. Hoteliers deal with strong competitors, and typical everyday rate (ADR), a procedure of typical understood space leasings each day, stays low.

” Thailand’s tourist market continues to ride the crest of a wave, with record-breaking varieties of international visitors clamouring to experience the nation’s lots of destinations,” stated Costs Barnett, handling director of C9 Hotelworks. “As the nation’s capital and significant global entrance, Bangkok is quick turning into one of the world’s excellent megacities.”

A series of multi-billion-baht advancements, consisting of transportation links, megamalls, destinations, hotels and property tasks, are changing the cityscape, Mr Barnett stated, producing both chances and hazards for the city.

THA president Supawan Tanomkieatipum forecasts that the hotel sector will grow by 5-7% in 2018, thanks to more arrivals and a strong economy.

The association anticipates a strong rebound from hotels in the South, specifically in Phuket, Krabi and Koh Samui, as the Chinese market continues to establish and Russian and other European travelers return. The remainder of the nation will see more moderate hotel development, the THA stated.

In 2017, the typical tenancy rate for signed up hotels in the South was 80-85%, compared to 70% for the North, 75% for Bangkok and 65% for the Northeast. Based upon tenancy rate, the majority of areas revealed a minor boost other than for Phuket, which saw a sharp rise.

Bangkok provide up

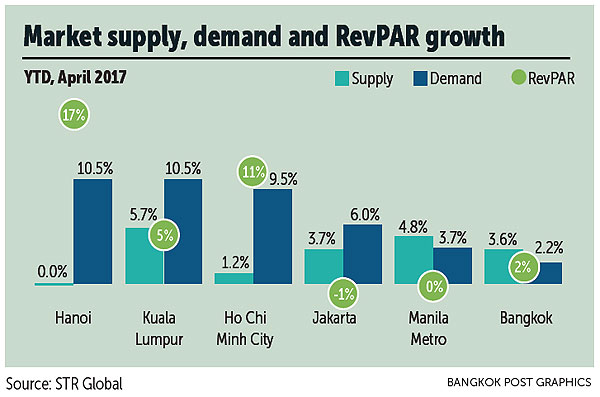

The current research study from STR International programs that require for hotel spaces in Asia and the Pacific area grew by 6% from January to April 2017. However the typical everyday rate (ADR) fell by 0.5% as supply increased 2.8%.

In Southeast Asia, Thailand stayed the biggest market in regards to global arrivals in 2016, followed by Malaysia, Singapore, Indonesia and Vietnam, with particular development rates of 9%, 4%, 8%, 16% and 26%.

Surprisingly, hotel supply in Bangkok increased by 3.6% throughout January-April 2017, overtaking need development of 2.2% and profits per space offered space (RevPAR) which climbed up simply 2%.

At the very same time, the variety of brand-new hotels in Hanoi was flat however need leapt 10.5% and RevPAR by 17%. Supply in Ho Chi Minh City was up just 1.2%, however need increased 9.5% and RevPAR grew 11%.

Residential or commercial property companies circling around

In 2017, huge residential or commercial property business such as Origin Home, Singha Estate and Sansiri Plc, in addition to little and medium-sized operators, got in the hotel sector.

Some foreign hotel brand names likewise emerged in Thailand or revealed strategies to open quickly.

Sansiri Plc, for example, has actually carried out an enthusiastic abroad financial investment drive in hospitality and way of life brand names, investing US$ 58 million (1.9 billion baht) for a 35% interest in US-based store hotel group Requirement International. The high end Requirement runs many hotel brand names in Los Angeles, New York City and other United States cities.

In its home market, Sansiri is set to open 3 more Escape Hotels in the next 3-5 years after getting in the hospitality company 4 years back, with 2 residential or commercial properties in Hua Hin and Khao Yai.

In December, Origin Residential or commercial property and Japan’s Nomura Realty Advancement revealed a financial investment collaboration on 3 hotel tasks worth 7.5 billion baht in Bangkok and in Sri Racha district, Chon Buri. The brand-new hotels will be handled by InterContinental Hotels Group (IHG) under brand-new brand name Staybridge Suites.

Another Thai designer, Singha Estate, prepares to invest 51 billion baht on a job in the Maldives, including hotels, duty-free stores, a convention hall, a marina and home entertainment complexes. Singha calls it among the most costly advancement tasks ever in the first-rate tourist location.

Brand name brand-new for launch

Over the next couple of years, more brand-new brand names are arranged to open in Thailand, beginning with Hyatt Regency Bangkok Sukhumvit in the 3rd quarter of 2018. The residential or commercial property will be the very first Hyatt Regency hotel in Bangkok, signing up with sis Grand Hyatt Erawan Bangkok, Park Hyatt Bangkok and Hyatt Location Bangkok Sukhumvit.

Centara Hotels and Resorts has actually likewise drawn up a technique for releasing 3 brand-new brand names in the 2nd quarter of 2018, 2 in the high-end sector and one in the mid-scale classification.

On The Other Hand, Minor Hotels revealed in December that it had actually taken a substantial stake in British-based Corbin & & King. Small strategies to utilize the close collaboration to broaden a portfolio that consists of dining establishments like the Wolseley, the Delaunay and Brasserie Zedel, in addition to the Beaumont Hotel.

Brands from overseas have actually likewise paraded into the Thai market.

American hotel chain Travelodge is set to run hotels in Chiang Rai, Chiang Mai, Khon Kaen, Hua Hin, Rayong, Phuket, Khao Lak, Koh Samui and Krabi by 2020. In 2017, Travelodge debuted in Bangkok and Pattaya.

Another brand name is Japan’s Prince Hotels and Resorts, which just recently concurred an offer to handle its very first hotel in Thailand (in Prachuap Khiri Khan’s Pran Buri district) by 2020.

For regional chains like Urban Hospitality Group (UHG), a way of life hotel and realty designer, prepares require constructing hotels to serve generally foreign travelers, consisting of the Quarter Riverfront at Chao Phraya River Hotel at an expense of 1 billion baht.

UHG stated the area of the task, on the Chao Phraya River in Bangkok’s Thon Buri location, has actually been rejuvenated with the launch of neighboring tasks such as IconSiam, the Bangkok Observation Tower, the Thailand Creative and Style Center, the Golden Train Line, Banyan Tree House, 4 Seasons Private Residences Bangkok and Lhong 1919 market.

3 megatrends

SCB’s Economic Intelligence Center (EIC) has actually kept in mind 3 megatrends set to drive the hotel and tourist sectors:

Group modification, specifically the increasing variety of elderly people who will represent an ever-larger share of global journeys and take a trip costs.

Intensified global competitors for arrivals and traveler costs as federal governments relieve visas and promote tourism-related financial investments.

The increasing supremacy of mobile phones and social networks in daily life and amongst customers, requiring organizations to adjust.

The EIC recommends some techniques for Thai tourist organizations to deal with modification and increase their competitiveness:

Distinction to draw in quality travelers, such as by promoting brand-new market sectors that have light competitors and counting on the individuality of regional locations and culture.

Collaborations with associated organizations in order to include worth, such as by making the most of Thailand’s strengths in medical tourist to develop plans for older tourists and foreign senior citizens.

Utilizing innovation and online media to decrease expenses and broaden client reach.

These megatrends position chances and difficulties. Thai organizations need to be proactive and a make changes as quickly as possible, the EIC stated.