Asean’s future is intense and it will benefit even more from emerging styles connected to the usage economy, states Requirement Chartered.

The 10-country area will stay a significant recipient of international foreign direct financial investment (FDI) as its economies are beginning to recuperate from the lengthy coronavirus pandemic, thanks generally to consumption-led development and a broadening middle class, according to the UK-based monetary services group. In addition, suppressed tourist need might benefit the area’s economy as nations open to global visitors.

To promote the economy and additional draw in foreign financial investment, the area will, nevertheless, require to broaden on the locations from which it looks for development, executives state.

Benjamin Hung, CEO for Asia of Requirement Chartered, stated Asean has actually gone through a challenging duration, especially in the 2nd and 3rd quarters of this year when nations enforced brand-new Covid lockdowns, causing an interruption of production and supply chains.

” However we are slowly seeing things enhancing and in reality speeding up throughout a variety of markets,” he stated at a current media roundtable held by the bank. “Regardless of the difficult duration, I personally see Asean at a tipping point of a considerable reset and there are a couple of considerable patterns that would be useful for Asean throughout the next 5 to ten years.”

The emerging patterns poised to drive additional development, he stated, focus on geopolitics, middle-class usage power, the increase of digitisation, and an increased concentrate on sustainability.

” From a geopolitics viewpoint … what is intriguing is that China is extremely eager to establish closer ties and a more intimate supply chain relationship with Asean as a bloc,” kept in mind Mr Hung.

” The United States is likewise extremely eager to establish Asean as an option in regards to the diversity of supply chains. Similarly for the European markets and within Asia, Japan, South Korea and China are extremely thinking about buying Asean.”

Resource-rich Asean boasts a young and growing population of 660 million in addition to an increasing middle class. With a GDP of US$ 3 trillion, it is the 3rd biggest market in Asia after China and Japan. Typical GDP per capita in the Asean-10 is around $5,000, and the figure is close to $5,500 for the Asean-6 markets.

” At this level, you are seeing more rapid development in regards to usage per capita moving forward which would be significantly a driving force for GDP development. We should not undervalue that power to drive development,” stated Mr Hung.

More international business (MNCs), looking for to take higher benefit of the capacity of Asean markets, are checking out a China-Plus 1 method in the area.

” In the past, Asean has actually been more of a production center for the usage market in the West,” stated Mr Hung. “Moving forward, I believe significantly we will see Asean production for usage by the East.”

According to Mr Hung, in spite of the effect of Covid, Asean’s share of international FDI increased to 14% in 2015 from 12% in 2019. “That is a reflection of how the world sees Asean as the future and as a possibility. Regardless of brand-new Covid variations or near-term obstacles, we see an extremely favorable possibility and development in Asean.”

Echoing Mr Hung’s insights, Kingshuk Ghoshal, Requirement Chartered’s head of international subsidiaries in Singapore and Asean, stated a detailed series of studies and conversations held by the bank with business pertaining to Asean discovered typical styles around the usage economy and the growing middle class.

” Great deals of western MNCs wish to have their production centre near the usage centers, which is what Asean is emerging to be,” he stated. “Instead of having a long supply chain that can be interfered with, this is the time when our customers are taking a look at rebalancing.”

Digitisation is likewise altering the landscape substantially in regards to how individuals take in and spend for things. The gross product worth of e-commerce in the area is anticipated to triple to $300 billion over the next 5 to 6 years.

Over 60% of the Asean population remains in the middle class, and more than 400 countless them are internet users. “That moves an extremely engaging e-commerce or digital economy proposal,” stated Mr Ghoshal.

” In the past, Asean has actually been more of a production center for the usage market in the West. Moving forward, I believe significantly we will see Asean production for usage by the East,” states Benjamin Hung, Requirement Chartered CEO for Asia.

ESG FINANCIAL INVESTMENTS

Growing usage has actually caused greater need for energy and the area, however customers and federal governments alike understand that the energy of the future requirements to be sustainable. This is drawing in more financial investments connected to ESG (ecological, social and governance) styles.

” Now is in fact the minute for sustainable and renewable resource development,” stated Mr Ghoshal. “Asean federal governments have actually come together as they have actually dedicated to making a minimum of 23% of the energy mix from renewables by 2025. That’s considerable, thinking about much of this will originate from brand-new financial investments in this location.”

Indonesia, for instance, is seeing strong interest from Requirement Chartered customers in renewable resource tasks and other tasks connected to the shift to net-zero carbon emissions.

For instance, the bank has actually partnered with Indonesia’s PMSE to co-finance the 145-megawatt Cirata drifting solar photovoltaic power job in West Java. The biggest of its kind in Southeast Asia, Cirata is set to start industrial operation in the 4th quarter of 2021, offering sufficient electrical power to power 50,000 houses, balancing out 214,000 tonnes of CO2 emissions, and developing as much as 800 tasks.

Mr Hung stated Asean continues to be among the bank’s essential earnings factors in Asia. “Increased intra-regional connection through capital circulations, combination of production networks, in addition to vertical or horizontal combination of supply chains will assist enhance Asean’s function in the international supply chain shift,” he stated.

Nevertheless, connection should likewise be reinforced in between the area and the rest of the world. “Asean should continue to take part in open market contracts and deepen its engagements with international trading partners.”

The finalizing of the Regional Comprehensive Economic Collaboration (RCEP) is a favorable declaration of Asean’s desire to preserve open trade circulations. Greater coordination and improved connection in locations from green facilities to digitisation will boost local development for the long term.

” Great deals of western MNCs wish to have their production centre near the usage centers, which is what Asean is emerging to be,” states Kingshuk Ghoshal, head of international subsidiaries in Singapore and Asean for Requirement Chartered.

MULTILATERAL TIES

” A variety of our customers from numerous passages, such as US-Asean, Europe-Asean, China-Asean, Intra-Asean, are most eager to have access to Asean on the back of the numerous open market contracts and trade treaties that are being formalised,” Mr Hung informed Asia Focus

The Comprehensive and Progressive Contract for Trans-Pacific Collaboration (CPTPP) will continue to be useful for trade with taking part passages, he included.

” We are seeing customers from various trade passages prioritising selective financial investment sectors. United States tech business, for example, are buying cloud services and information centres, medical gadgets and pharma, while European business are investing into sustainable tasks, specialized chemicals.”

Such multilateral collaborations are likewise anticipated to bring complementary advantages in regards to sector abilities and resources that will eventually result in a more fair circulation of financial development throughout Asean.

For instance, electrical car (EV) producers might tap the varied yet complementary relative benefits in the vehicle sectors of Thailand, Indonesia, Vietnam and Malaysia to invest, produce and source for their house markets, thus producing tasks, abilities and trade, he stated. Life sciences, pharmaceuticals and electronic devices are likewise amongst prospective development locations for Asean.

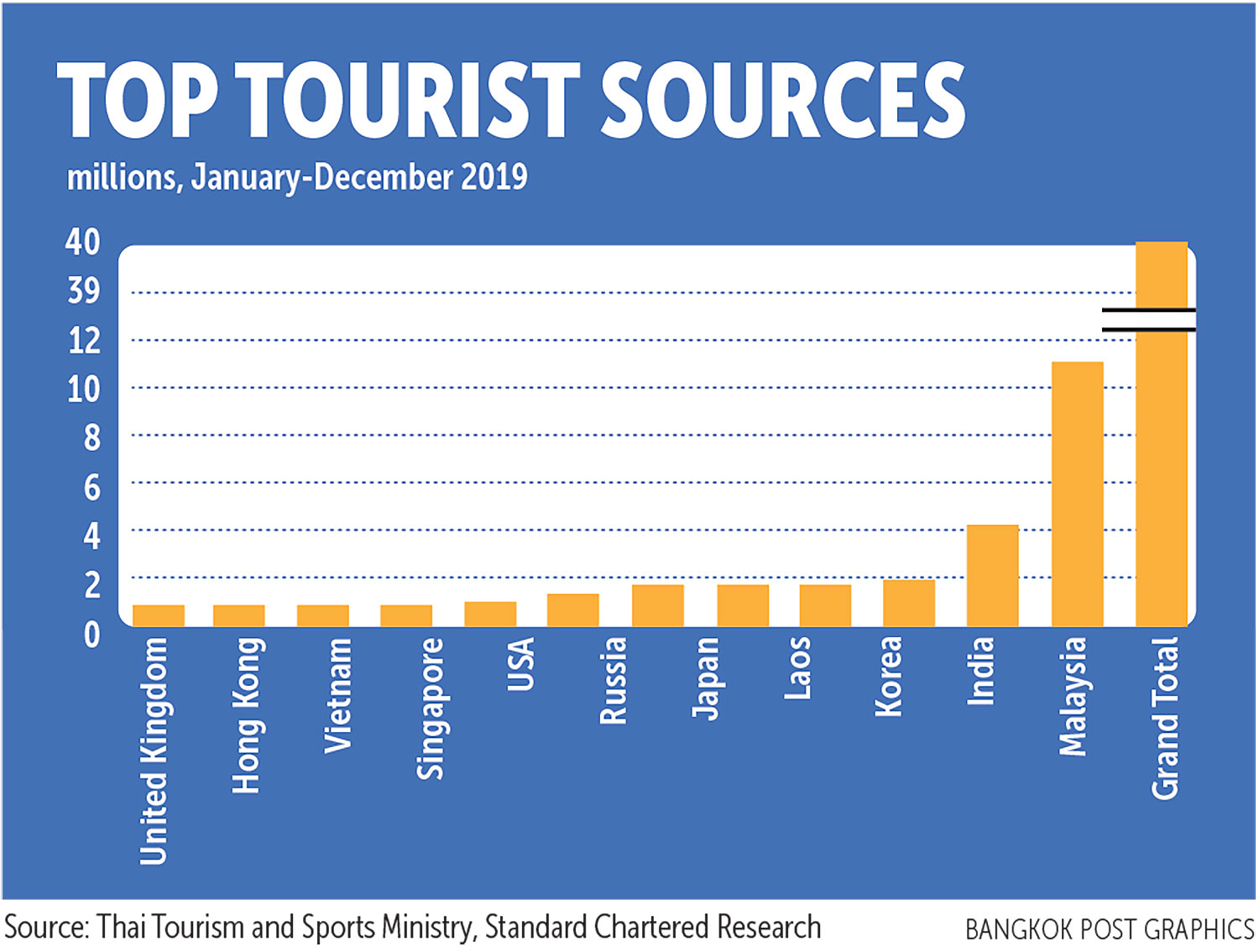

Mr Hung likewise kept in mind that Thailand’s choice to resume to global travelers beginning on Nov 1 is a “excellent start”.

” I believe what Thailand is doing is absolutely best. That instructions is clear. The entire world has actually had such a considerable extended period of lockdowns. There is suppressed need for travel.”

ENGINE OF DEVELOPMENT

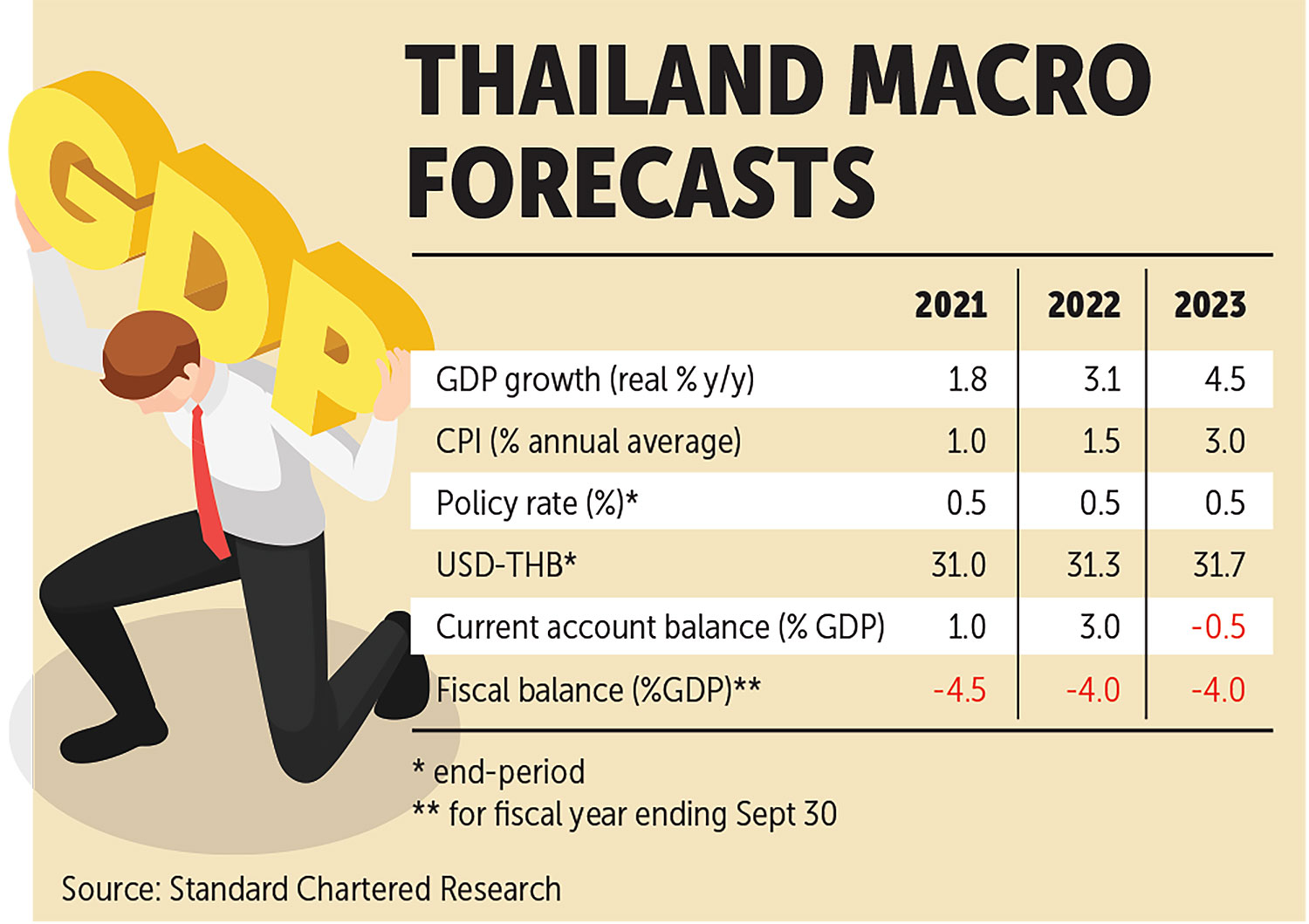

With tourist contributing 15% to Thailand’s GDP, the federal government is preparing to resume Bangkok and other essential locations such as Chiang Mai, Pattaya, Hua Hin and Phetchaburi to support development into 2022.

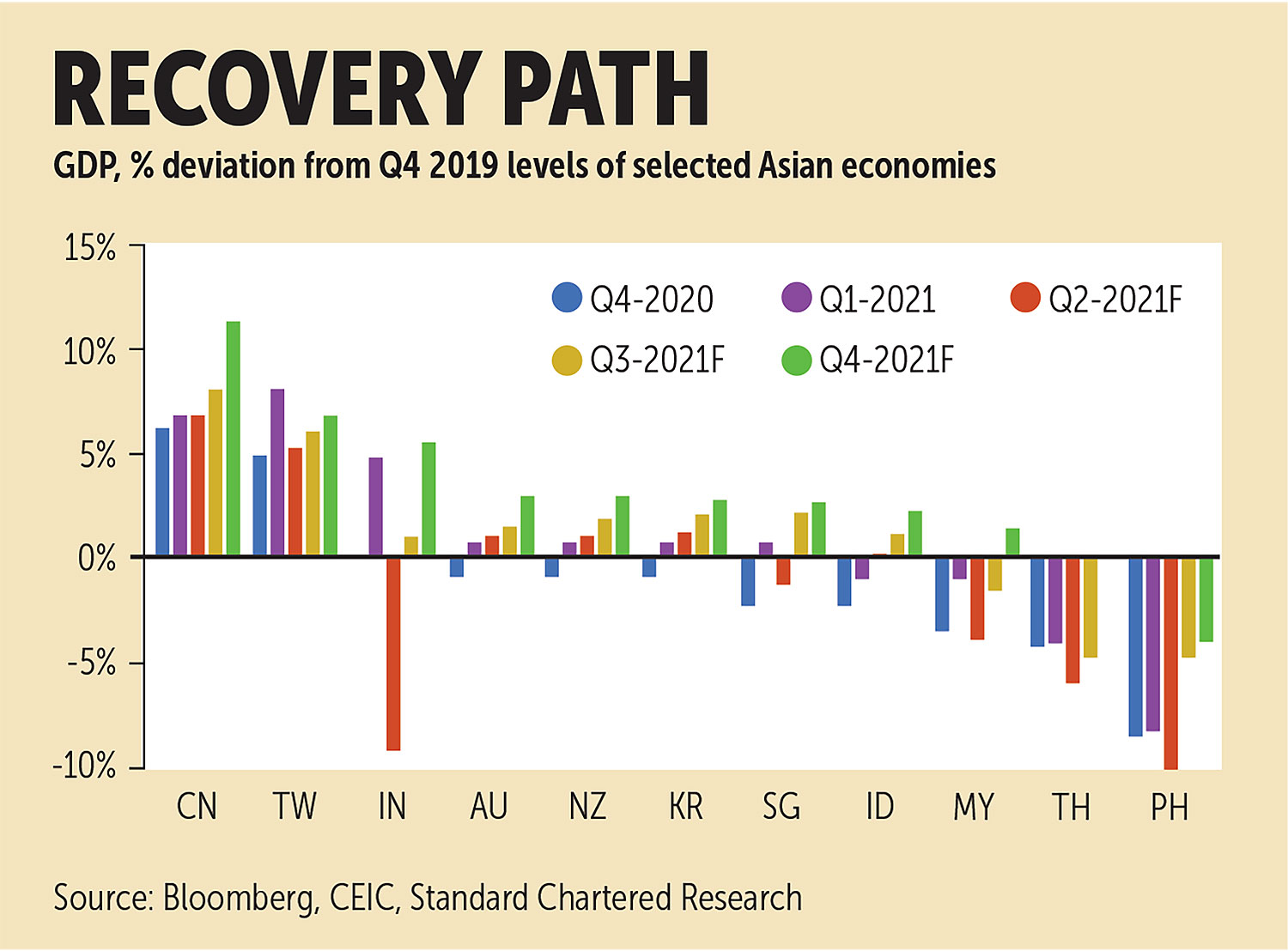

” The Thai economy will have a hard time to recuperate without an enhancement in the tourist sector, in our view,” Requirement Chartered stated in an Oct 8 research study report. The Ministry of Tourist and Sports, it included, anticipates 15 million visitors next year, compared to the pre-Covid overall of 40 million in 2019.

” While a clearer tourist rebound is most likely to emerge this quarter, we anticipate the sector to take a minimum of 3 years to recuperate to pre-Covid levels,” the report stated.

The Ministry of Public Health anticipates brand-new Covid cases to decrease to about 5,000 daily prior to completion of October, from more than 23,000 at the peak in mid-August, although it stays worried that everyday infections might increase once again later on if there are effects from additional relaxation of containment steps in October.

While the near-term outlook stays difficult, Basic Chartered predicts intense potential customers for the Asean economy in the medium term.

Asean can development nearly two times that of the international economy in the medium term. Mr Hung stated. “From that viewpoint, I believe Asean will still be an engine of development,” he concluded.