More than three months after “assessable” foreign income became taxable, many of Thailand’s expats are still swimming in a sea of uncertainty. Lots of advice online, but few definite answers. Senior officers from the Revenue have said little of late, although there has been a half-promise to the Swiss ambassador in a televised interview to print the tax identification forms in English as well as in Thai.

There is a view amongst some Thai lawyers that we must wait until July for clarification on nitty-gritty issues such as double taxation treaties and the tax status of pensions. By that time, some expats will have passed 180 days of minimum residence necessary for tax liability in this category. However, other specialists argue that the Revenue needs not to clarify anything. After all, formal tax law did not change on January 1 2024. There was simply the closing of a tax loophole which had enabled Thais or foreigners to delay transferring income here until a subsequent year.

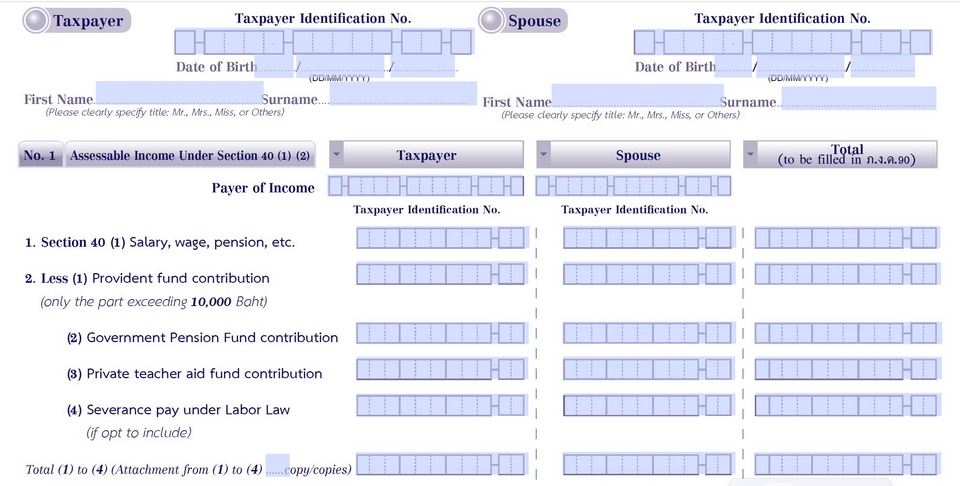

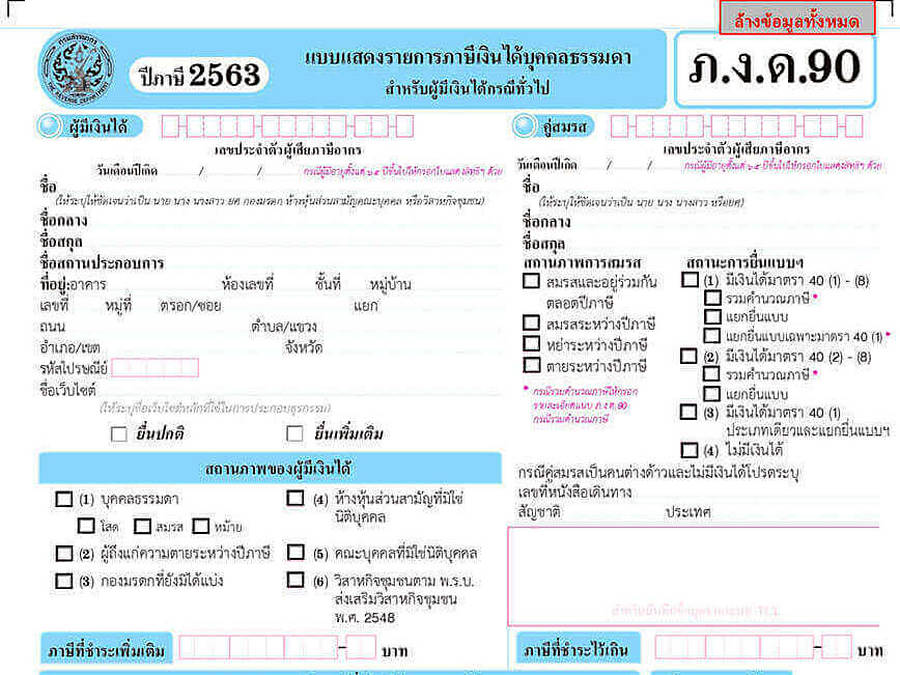

Will all foreigners who spend half a year or more in Thailand be required to register with the Revenue by obtaining a tin (tax identification number) and submitting the required forms? The submission deadline for the calendar year 2024 will be in the January-March quarter of 2025. Revenue spokespersons have hinted at the all-inclusive scenario, but there has not been a formal declaration. Could the tax offices cope with the rush?

There are some categories of foreign tax residents who will not be liable at all this year, for example those who do not transfer ANY foreign income to Thailand in 2024 as well as holders of the 10 year Longterm Residence Visa who are exempt from declaring any foreign income in any case. The fact that you may be required to submit forms does not mean that you are, in fact, liable to pay any Thai tax. But expats won’t welcome the envisaged bureaucracy and likely registration with two tax authorities: the home country and Thailand.

There is also ambiguity about the precise status double taxation treaties. A retiree, for example, might argue – and indeed prove – he or she has paid taxes on pensions in the home country. But the Revenue could argue that the retiree could use those payments as a tax credit in Thailand rather than conceding a total immunity. Everyone agrees that the revised rules about foreign income are designed to catch Thais (and foreigners) making profits from untaxed overseas businesses and foreign exchange and crypto currency trading. The problem, needless to say, could be small fish being caught in the net alongside big ones.

The optimistic view about the future is that tin registration will remain voluntary as, in fact, it always has been for Thai citizens. If you think you are liable for tax, then by all means register. If you try to cheat, the newish Common Reporting System – an automatic and international exchange of the financial information of individuals to combat tax evasion and ensure compliance – will expose your dealings. But if all expats living here for half a year or so are thrown into the same pit willy-nilly, then Thai authorities can expect non-working longstay expats to become an endangered species. Imagine the note on official publicity for one year extensions or for Elite visas: “You are reminded that you are required to register with the Thai Revenue’s tax identification system if staying in Thailand more than 180 days in a calendar year.” Not exactly marketing.