After seeing revenues double this year, KTB Securities Thailand (KTBST) anticipates earnings development next year to stagnate since of poor-performing Thai capital markets brought on by the sluggish roll-out of a coronavirus vaccine.

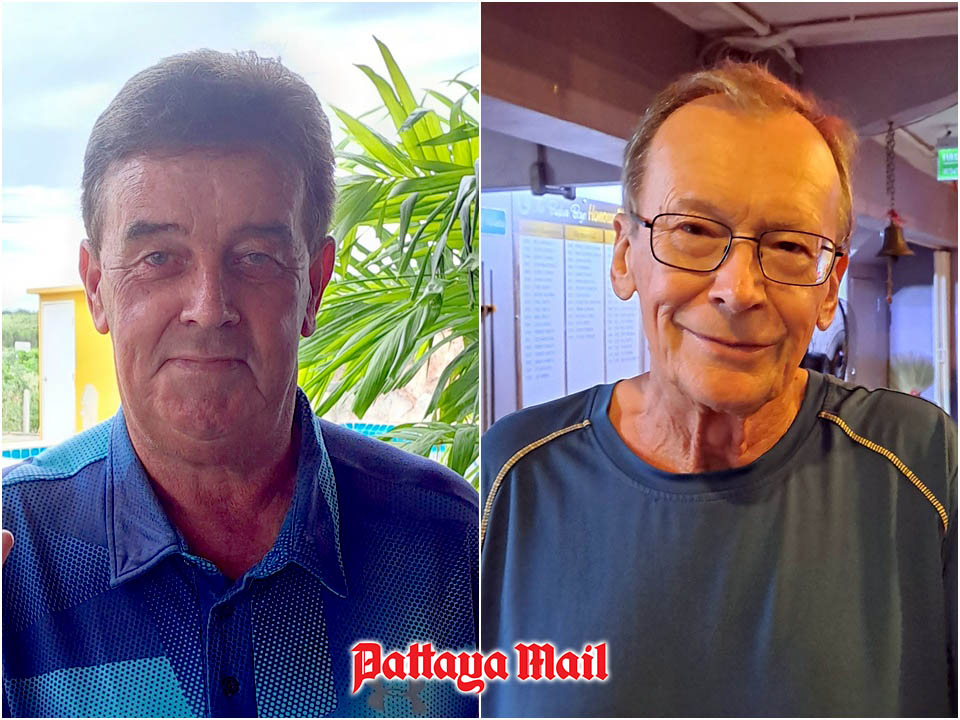

Win Udomrachtavanich, executive chairman, KTB Securities Thailand Co Ltd.

The business, established in 2016 as a majority-owned spin-off of Korea-based KTB Financial Investment and Securities, saw revenues skyrocket this year to 70 million baht for the very first 11 months from 30 million for the complete year of 2019.

KTBST has actually likewise grown this year in regards to size, increasing in the rankings from 29th biggest broker to 26th out of an overall of 44.

KTBST executive chairman Win Udomrachtavanich stated the business had the ability to make the most of foreseeable motions in the market following the break out of Covid-19 and gained the benefits of previous financial investments in brand-new company sections such as possession management and insurance coverage.

” This year for brokers, we had more chances since forecasts were simpler,” he stated. “In 2019, the volume was rather bad and organizations were not trading since the marketplaces did not have any instructions. However this year we were fortunate since we had the plunge in March and after that we understood if absolutely nothing else failed there would be a rebound.”

Nevertheless, Mr Win stated trading on Thai stock exchange in 2021 is not likely to be as profitable since of Thailand’s middling position in regards to access to a Covid-19 vaccine and a sluggish financial healing where GDP is forecasted to recuperate just half of what was lost in 2020.

Mr Win encourages financiers to move their funds overseas, especially into the United States tech, health care and biomedical sectors. Presently 80% of the 6 billion baht in personal possessions KTBST handles remain in domestic possessions, while 20% remain in foreign.

Its broker sector contributes 50% of its general company and will likely revert back to its 2019 revenues in 2021, so he is counting on brand-new funds from its realty financial investment trust (REIT) company, a boost in insurance coverage sales and development in its personal fund from a relocation towards foreign possessions to continue to grow next year.

” Thailand will likely remain in the 2nd or 3rd batch in regards to vaccine receivers,” stated Mr Win. “Our research study group is taking a look at the 3rd quarter of next year in regards to when Thailand will have a shot at getting the vaccines. We can not make it ourselves, so we need to wait on AstraZeneca to deliver it to us.”

He stated Thailand will have access to the AstraZeneca vaccine since of an existing relationship in between the British pharmaceutical company and Siam Pharmaceutical Co, which is connected with the Crown Home Bureau.

” Next year you will see anything associated to digital succeed, however standard markets like banks might do improperly when the unique relief steps end that enable them to not reserve non-performing loans,” stated Mr Win. “We encourage customers to go to the United States for tech, health care and biotech, and likewise purchase green stocks most likely to take advantage of Joe Biden’s election success in the United States.”

For the oil and gas sector, KTBST stays neutral, implying the company can not forecast its instructions since of high volatility from external aspects. Nevertheless, Mr Win forecasts Mr Biden might cancel some overseas drilling operations as the United States president remains in favour of green energy, triggering supply to reduce and costs to increase.

While green energy is typically a bargain at this time, Mr Win encourages waiting to purchase electrical cars (EV), aside from the escalating Tesla.

” You will not see electrical cars and trucks comprise more than 15% of the marketplace in any nation anytime quickly. In the United States or China, they just consist of 5-8%,” he stated.

” Today you can not even drive from Bangkok to Pattaya, as you would not have adequate battery charge to return in numerous EVs, however they will end up being popular in the market in about 5-10 years.”