Brand-new condominium supply introduced in Pattaya dipped 95% in the very first half since of the excess of unsold systems in 2015 and a drop in foreign need throughout the pandemic.

Phattarachai Taweewong, associate director at residential or commercial property expert Colliers International Thailand, stated a a great deal of freshly introduced condominiums amounting to more than 15,500 systems in 2015 made designers freeze brand-new launches this year.

” Condominium need in Pattaya slowed after the infection struck internationally, as Pattaya’s residential or commercial property market greatly depends on foreign purchasers, especially Chinese,” he stated.

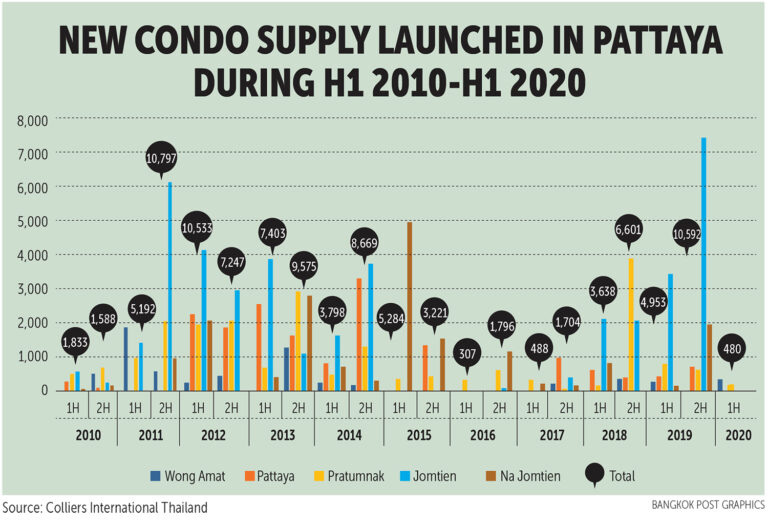

Colliers reported that 480 systems from simply 2 jobs were introduced in the very first half, compared to 4,953 systems in the very same duration in 2015.

Sales rate of the brand-new launch was 66%, a minor boost from the 2nd half in 2015, however the quantity of unsold stock in the market stayed high at more than 20,000 systems.

The number is collected from freshly introduced systems in 2018-19, which skyrocketed to 10,239 and 15,545 systems, respectively, up from 2,192 in 2017 and 2,103 in 2016.

Jomtien and Na Jomtien saw the most significant swimming pool of unsold stock, as there was strong competitors from numerous brand-new jobs in the previous couple of years with more than 1,500 systems per job.

Mr Phattarachai stated there were more than 10 jobs that stopped sales activity and job advancement after taping a sales rate of 10-20%, compared to 60% in the typical duration. The majority of remained in Jomtien.

3 jobs that had a low sales rate modified down market price by 10-20% to bring in purchasers, while some were either altered to hotel advancement or provided land for sale, he stated.

Wong Amat was the area with the most affordable unsold condominium supply of around 600 systems since the very first half this year, due to restricted uninhabited land for condominium advancement.

Central Pattaya was available in 2nd, as it was a popular area amongst regional and foreign travelers. Purchasers in this area chosen purchasing as a financial investment or own living.

” The most popular jobs with a great sales rate in the very first half were those providing ensured rental returns, as a lot of Pattaya condominium purchasers purchased a system as a villa,” he stated.

Rental return rates provided in the market varied from 5% for 3 years to 6% for 5 years or 7% for 3 years.

Typical asking price for beachfront jobs was 180,000 baht per square metre in Wong Amat. Other areas had a typical asking price of 160,000 baht per sq m for beachfront systems.

The most affordable typical asking price remained in Jomtien, which saw an increase of supply in the center to lower-end section. System costs began at 50,000 baht per sq m.

The typical prices at all areas dropped 10-20% in the very first half as lots of jobs, especially those with building finished and ready-to-transfer systems, provided discount rates.

” Development in facilities financial investment and Eastern Economic Passage efforts can assist Pattaya’s condominium market recuperate,” Mr Phattarachai stated.

The federal government’s megaprojects consisted of an agreement finalizing of area among the Map Ta Phut commercial port advancement stage 3, a high-speed train connecting 3 worldwide airports in Bangkok and Chon Buri, and an aerial metropolitan area and U-tapao airport advancement worth 290 billion baht.