A previous chairman of Baker McKenzie, the prominent legal services company based in Bangkok, has actually recommended that the questionable Thai Income statement might be objected to in court. Kitipong Urapeepattanapong, as reported in Thai Inspector, stated that the Income was reinterpreting an existing code which has actually functioned for 38 years. It is neither a law nor an administrative or ministerial policy and might well be challenged in court with a great chance of success. He argued that a brand-new law or a royal decree was required in these scenarios.

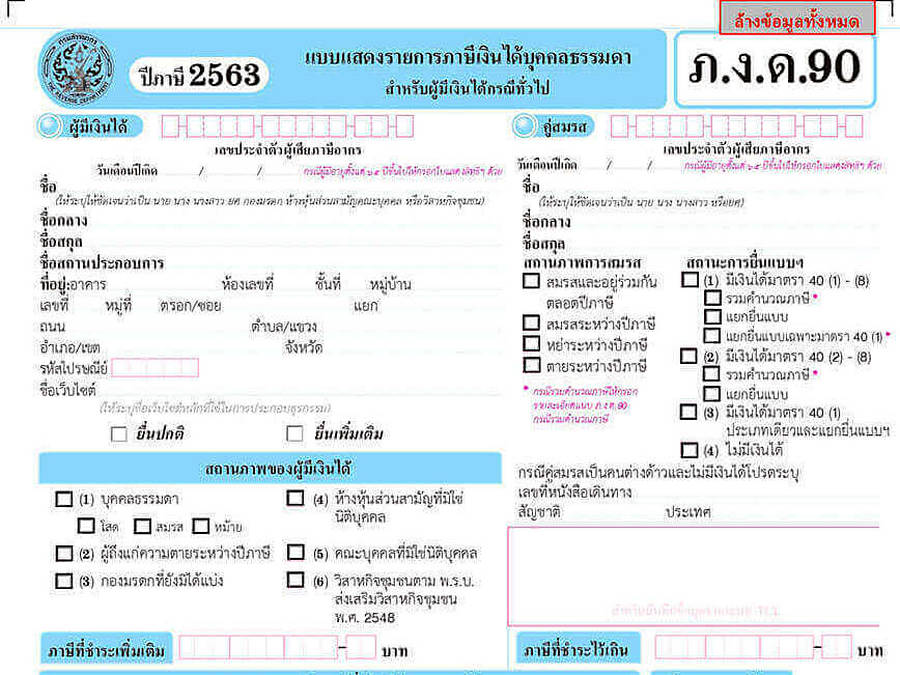

The Income last September provided a decree that, beginning in January 2024, tax needs to be paid on earnings generated from abroad from another jurisdiction anytime the money was created. This altered the 1985 policy that getting here earnings was just taxable if moved in the very same year it was made. Numerous expats, most likely most, are stressed that the Income will begin taxing them on earnings currently taxed in the home nation, primarily pensions and social security payments. If they reside in Thailand for more than 180 days in a year, they are considered locals accountable for tax.

Kitipong stated that his viewpoint was shared by other notables, consisting of a previous supreme court judge, although the Income would probably argue that its current declaration is merely an enforcement decree which does not need parliamentary intervention. The entire problem signs up with numerous other doubts and uncertainties which continue to afflict the entire topic. There is no doubt that the Income suggests to target primarily Thais or immigrants who delight in company earnings abroad, are currency speculators or have funds in overseas accounts consisting of Hong Kong. However the Income has actually stayed quiet for the previous 2 months and claims to be gathering details from stakeholders.

Law office analysts in Bangkok divide into 2 groups. Some think that normal expats have absolutely nothing to fear if living here on money currently taxed in the home nation. They typically price quote double-taxation treaties which Thailand has actually made with around 60 nations. Others, nevertheless, mention that double-taxation treaties are all various and do not always assure on points of issue presently highlighted in Thailand. Not to point out the prospective documents which expats may need to complete every year to encourage the Income of their excused status. Some are recommending that large amounts need to be sent to Thailand before completion of 2023. On the other hand the waiting video game for clear details drags out and on. The genuine response, naturally, is for Thailand to follow the example of Singapore and Hong Kong where the only earnings tax imposed is on money particularly made in their own particular areas.