Designers must freeze the supply of brand-new condos in Pattaya due to the fact that the coronavirus break out is harming need and will increase the variety of unsold systems to a record high, states residential or commercial property specialist Colliers International Thailand.

Phattarachai Taweewong, associate director of research study for Colliers, stated the effect from the infection on the condominium market will be serious in Pattaya, where the marketplace relies greatly on foreign purchasers, especially from China.

” The marketplace has actually been down given that in 2015 due to the fact that the Chinese, who comprise most of foreign purchasers in Pattaya, had troubles with cash transfers and felt the effect from the trade war,” he stated. “The more powerful baht and weaker yuan likewise compromised their buying power.”

Mr Phattarachai stated there will be finished condominium systems at jobs set up to move in the very first half to Chinese purchasers that will not be moved.

” These purchasers might discard the systems they reserved in spite of making deposits,” he stated. “These systems will go back to the marketplace as unsold supply.”

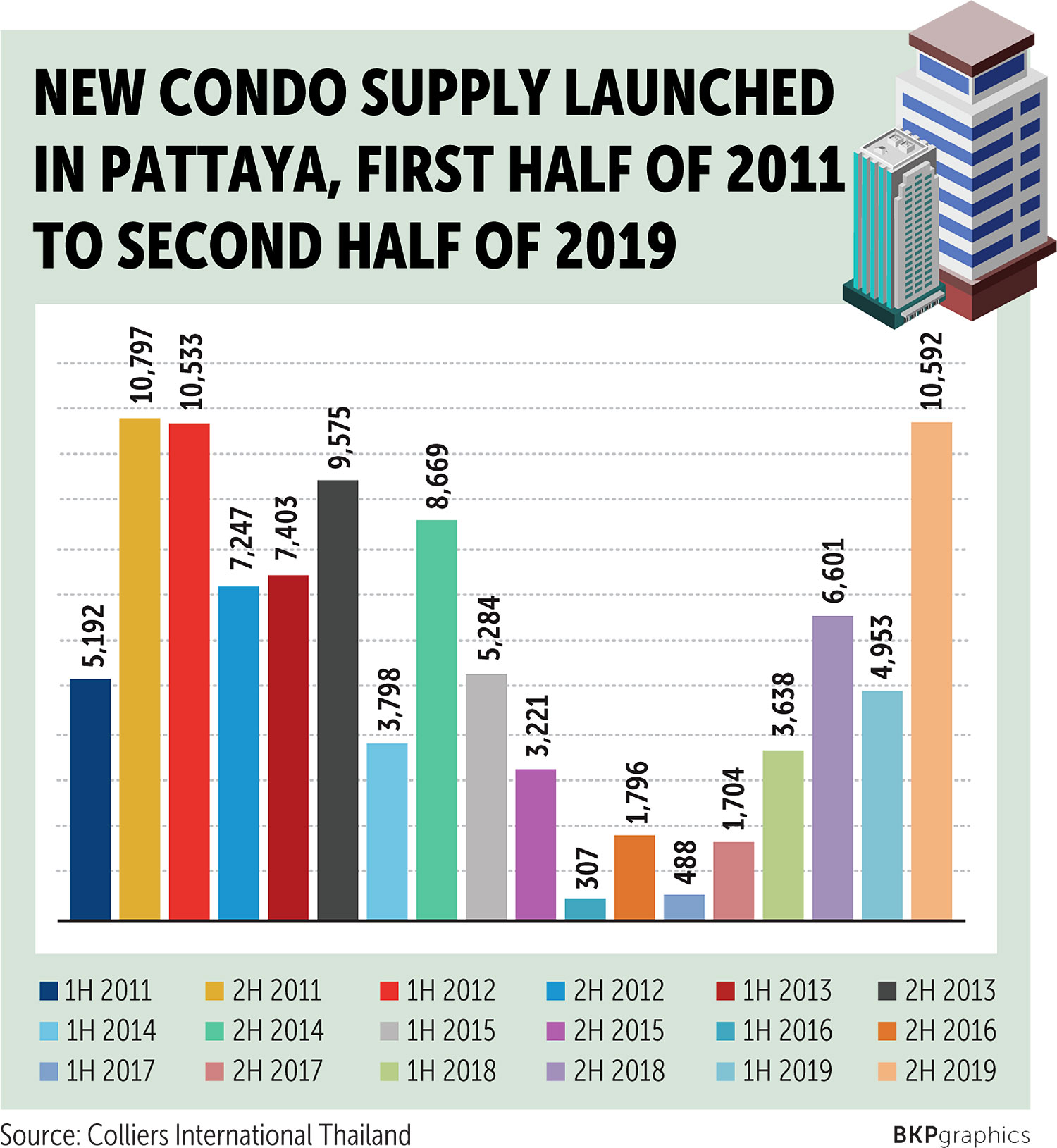

According to Colliers research study on the Pattaya condominium market, unsold supply surpassed 25,000 systems at the end of 2019, up from 12,800 systems in 2018.

The 2019 figure was a record high, beating the 2014 level of 19,140 unsold condominium systems.

The rise was mostly due to the fact that of an abundance of brand-new condominium supply introduced in 2015 with an overall of 15,540 systems, the most significant part in the previous 5 years.

Mr Phattarachai stated this year will see a minimum of 3 brand-new condominium jobs with an overall of 1,200 systems set up to release in Pattaya.

” As the coronavirus has actually moistened need, designers must wait up until existing supply is taken in,” he stated. “Otherwise the variety of unsold systems will skyrocket to a brand-new high this year.

” The marketplace will return next year as Chinese purchasers think about purchasing more abroad residential or commercial properties. To make it through the existing obstacle, designers must extend the transfer duration for Chinese purchasers and discover brand-new markets such as India and Europe.”

Colliers likewise reported a drop in the typical sales rate of brand-new condominium supply introduced in 2015 to 25%– below 35% in 2018, 38% in 2017 and 45% in 2016– due to the big quantity of brand-new supply introduced throughout the year.

The total sales rate of condominium supply was 73%, directly increasing from 2018. However the variety of returned systems will trigger the sales rate to drop to 70% by the end of 2020, Mr Phattarachai stated.

Jomtien and Na Jomtien have actually stayed popular areas amongst designers throughout the previous 5 years. Numerous jobs were massive advancements introduced by Chinese companies. Some included more than 2,000 systems per task.

The boom triggered these 2 areas to see the biggest variety of unsold systems in Pattaya, with about 20,000 systems at the end of 2019.

Wong Amat saw the tiniest variety of unsold condominiums at just 580 systems, due to restricted land supply.

” The most popular condominium jobs in the 2nd half of in 2015 were those using an ensured return, as condominium purchasers in Pattaya purchased them as 2nd houses,” Mr Phattarachai stated. “The program provides an option to make a much better return than transferring cash.”

He stated condominium need in Pattaya each year has to do with 35% of overall unsold supply.

The staying 25,000 systems will take a minimum of 3 years to soak up if there is no brand-new supply being included.

” As the marketplace stays slow and the variety of unsold systems was substantial, some designers froze advancement momentarily,” Mr Phattarachai stated.