A lot of expats in Thailand survive on earnings or capital, or both, developed over several years with tax currently paid in the nation of passport. They are naturally fretted by the impending modification in Thai Income practice– it is not a brand-new law gone by parliament– which will possibly tax brand-new and assessable foreign-sourced earnings start in January 2024. Pattaya Mail has actually gotten more worried reader feedback about this concern than any other throughout 2023. With inauguration day quickly approaching, here is our summary for the common expat who does not enjoy significant currency speculation, substantial profit-taking from abroad companies nor off-shore savings account concealing their money.

Has the Thai Income clarified the position of common expats? No. It is typically presumed that the Income is generally thinking about abundant Thais and immigrants who have actually controlled Thai tax guidelines in the past to prevent payments from abroad. Normal expats with home-country pensions or social security allowances are not part of this program, though in theory they might be captured in the crossfire. Talks are continuing in between senior accountancy companies, lobby groups and the Income about this and other problems. Do not anticipate responses whenever quickly.

Will my worldwide money transfers to Thailand from January 1 2024 be decreased on arrival by a Bank of Thailand tax levy? No. There will not be any modifications from present practice. You pay tax in defaults in Thailand by signing up at the Income for a tax recognition number and paying tax due, if any, in the next . There is no PAYE treatment in Thailand. The misconception that Thailand will tax worldwide transfers as the money shows up is a prevalent mistaken belief

Should I request a tax recognition number? Not unless you get a direction from a federal government source or the migration, both extremely not likely situations. It is practically particular that, at any rate in the early years, tax registration will be voluntary. If you think you have actually been taxed currently on your money sent out to Thailand, it’s finest to do absolutely nothing now. There is no requirement to utilize the services of tax accounting professionals if you are a normal expat (unless working here on a work license which is a different topic). The tax scenario as relates to money sent out to Thailand to buy home is a different source of obscurity.

A lot of nations with expats here have a double tax treaty with Thailand, so is that appropriate? That depends upon the specific phrasing of complicated files which vary significantly one from another. Double tax treaties are developed to be utilized just in cases where Thailand and the very first nation can not settle on who can tax. If Thai Income were to clarify unambiguously that formerly taxed earnings would not be retaxed, the concern would mainly pass away.

If I require to later on, how will I show that my money transfers to Thailand have currently been taxed? This will differ on a private basis. An expat’s income tax return or the action by the irs of the very first nation may be enough, or a basic declaration on a tax return may be appropriate. Couple of specialists, if any, think that the Thai Income has the staffing or the proficiency to handle more than 300,000 expats who are tax locals due to the fact that they invest more than 180 days here in a. It bears duplicating that the registration procedure will likely be voluntary. The Thai federal government is searching for the big wheel, Thai or foreign, and not the little fry.

How does Thai Income learn about your worldwide money transfers? A lot of nations worldwide, around 120 and consisting of Thailand, are now part of the CRS (Common Reporting System) which needs banks worldwide to eliminate tax evasion and to safeguard the stability of tax systems by sharing your banking deals with partner nations. This suggests that your worldwide transfers have actually been/ are/ will be kept an eye on by Thai monetary authorities. Some specialists think that Thai Income will utilize CRS as the path to question abundant Thais and immigrants about big worldwide deals. Among the nations not signed up for CRS are North Korea and the Vatican.

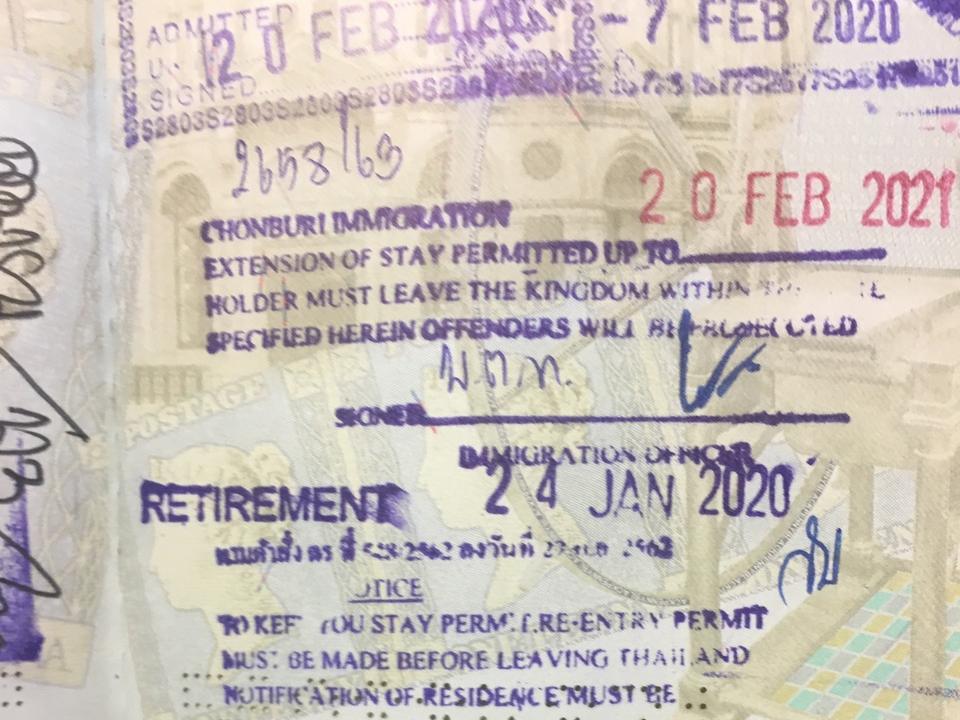

What is the Thai federal government truly approximately? The brand-new post-coup federal government merely wishes to raise money, in part to assist spend for its populist policies such as the 10,000 baht distribute plan. One can presume that no one in authority has actually yet believed seriously about the impacts of the modification on the expat market here and the possible unpopularity among long-lasting visa holders consisting of one year retirement extensions, Elite and the ten years Long Term Home. If you are an expat living in Thailand for a minimum of half the year, with no significant monetary tricks to avoid Thai Income, then it’s finest to do absolutely nothing till the scenario is clearer. That’ll take numerous months yet. However no point in loading your bags in disgust and leaving for Cambodia. They are a CRS nation too.