Wrap-up: A number of Asian stock exchange closed lower the other day as financiers reassessed the effect of the Covid-19 break out after a modification in the reporting approach in China exposed a spike in cases.

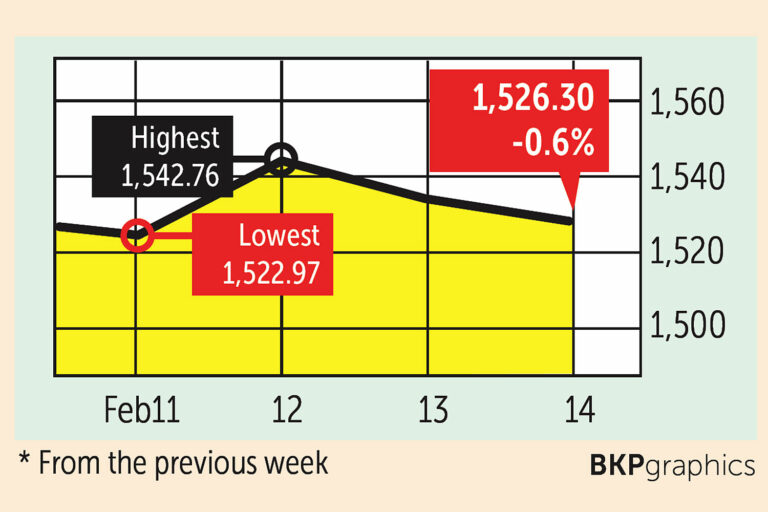

The SET index moved in between 1,522.97 and 1,542.76 points and closed at 1,526.30, down 0.6% from the previous week, in turnover averaging 53.92 billion baht a day.

Brokerage companies were net purchasers of 1.8 billion baht, retail financiers purchased 855.9 million and institutional financiers bought 380.5 million worth of shares. Foreign financiers were net sellers of 3 billion baht.

Newsmakers: The around the world death toll reached 1,383 the other day with reported cases amounting to 64,448 as the Covid-19 infection continues to spread out, while Japan discovers brand-new infections on cruise liner and Chinese Grand Prix delayed in the middle of the extended pandemic.

-

.

- Chinese customer costs in January increased by 5.4%, the most in more than 8 years, as the coronavirus increased need for durable goods and shuttered organization activity in parts of the nation.

- .(* )The Singapore Airshow, Asia’s greatest aerospace occasion, proceeded on Tuesday, even as the coronavirus continued to hammer the air travel market and some 70 exhibitors had actually taken out since of health issues.

- .(* )The Japanese carmaker Nissan has actually submitted a civil suit versus previous chairman Carlos Ghosn. looking for US$ 90 million in damages since of the fugitive executive’s supposed misbehaviours.

- Plane on Thursday reported a bottom line of EUR1.36 billion in 2019 after being struck by a EUR3.6-billion fine over a bribery scandal and additional advancement expenses for the A400M transportation airplane.

- Financier self-confidence in Thailand for the 3 months through April has actually fallen under bearish area for the very first time in 4 years, in the middle of a grim tourist outlook and geopolitical stress.

- Service self-confidence succumbed to the 11th straight month in January, with the infection break out contributing to issues.

- .

- .

- .(* )The federal government has actually authorized emergency situation relief for the domestic Mice (conferences, rewards, conventions and exhibits) market after global conferences decreased by practically 50% due to the Covid-19 break out.

- Thailand is at threat of being up to 3rd put on the world rice export table behind India and Vietnam, the Thai Rice Exporters Association cautions. Dry spell, weaker competitiveness and an absence of rice ranges to satisfy altering market need might press deliveries down to 7.5 million tonnes, the most affordable because 2013, it stated.

- Worldwide sugar costs have actually risen 12% this year to a two-year high as dry spell has actually cut deliveries from Thailand, the world’s second-biggest exporter. Early indicators are for a little harvest in the next crop year beginning in October also.

- Just 25 billion baht of the state financial investment spending plan was paid out in the very first 3 months of financial 2020, as the months-delayed 3.2-trillion-baht spending plan expense has yet to be imposed, stated a Financing Ministry source.

- .(* )The Bank of Thailand is preparing brand-new standards to manage the method banks determine costs for a host of services and products in the 3rd quarter as part of a push for a fairer cost structure.

- Land costs in the 4th quarter of 2019 resumed double-digit development as designers ran away the oversupplied apartment market and went after plots to establish more low-rise real estate tasks.

- Overall Gain Access To Interaction (DTAC) is at threat of losing a big portion of high-end postpaid customers after the 5G auction tomorrow as it prepares to bid just for the 26-gigahertz variety just, states Kasikorn Securities.

- SET-listed designer Residential or commercial property Perfect (PF) prepares to offer possessions worth a combined 10 billion baht to decrease financial obligation as the residential or commercial property market decreases.

- BCPG Plc, the sustainable power arm of Bangchak Corp, has actually taken control of Nam San 3B Power Sole Co, running a hydropower plant and transmission line system in Laos in an offer worth US$ 113 million.

- Bank of Ayudhya( BAY )states its non-performing loan ratio might go beyond the 2.5% target for this year if its projection for Thai GDP development is slashed.

- .

- .

- .

- .

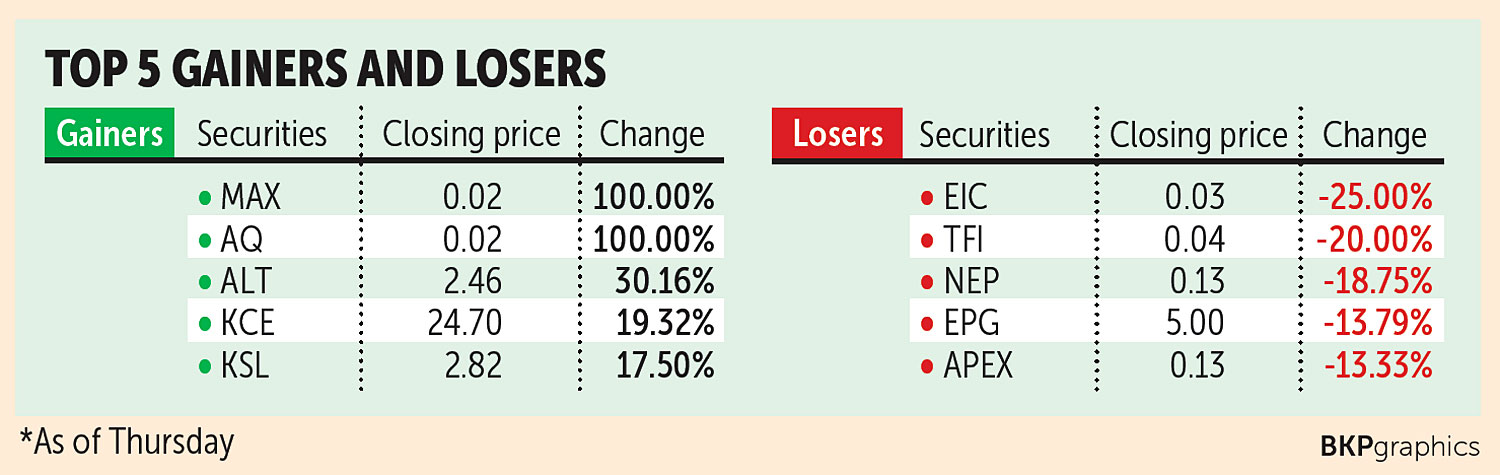

- Capital Nomura Securities advises various financial investment styles. Cyclical plays consist of PTT, PTTGC, SCC, TOP and BCP. CPF, TVO, GFPT and KSL are poised to acquire from a rise in food costs, while recipients of the 5G auction are ADVANC, REAL and ETRON. Under a worldwide wealth result style, its choices are BDMS, AOT, BH, BCH, MINT, CENTEL and ERW, while worth plays are BBL, KBANK and KKP.

- Technical view:

.(* )The cordless market ditched its greatest yearly display after the coronavirus break out stimulated an exodus of individuals. It was the very first cancellation in the 33-year history of the Mobile World Congress, which typically draws more than 100,000 individuals to Barcelona.

.(* )The Japanese innovation financier SoftBank Group stated its net revenue plunged almost 70% for the 9 months to December as financial investments in business such as WeWork and Uber took a hit.

.

.

.

.(* )The effect of Covid-19 might lower Thailand’s small GDP by in between 0.09% and 0.13% if the break out lasts longer than 3 months however less than 6 months, states Kasikorn Research study Centre.

Tourist authorities are once again proposing visa-free entry for Chinese people as part of a tourist revival plan, as the reserve bank and others anticipate financial development might fall listed below 2% this year.

Hotels are cutting down on personnel in reaction to weaker need from Chinese visitors, specifically on Ratchadaphisek Roadway in Bangkok and in Pattaya.

.

.

.

.(* )The cabinet is anticipated to choose by April or May whether Thailand will sign up with the Comprehensive and Progressive Contract for Trans-Pacific Collaboration (CPTPP), the treading bloc of 11 Pacific Rim countries omitting the United States.

.

.

.

.

.

.(* )The merged bank from TMB Bank and Thanachart Bank intends to have half of its client base utilizing its mobile banking app by year-end, states retail banking officer Anuwat Luengtaweekul.

Krungthai Bank might be needed to reserve greater loan-loss arrangements to handle a prospective bad-loan uptick this year as drooping economy strikes the degrading debt-servicing capability of customers.

Showing Up:(* )Japan will launch initial fourth-quarter GDP information on Monday. On Tuesday, Britain will reveal January joblessness figures and Germany will launch the January ZEW financial belief index.

Japan will launch January trade figures on Wednesday, with Britain and Canada launching January inflation the exact same day. China will reveal its 1 year loan prime rate on Thursday and Germany will launch March customer self-confidence. Japan will reveal January inflation on Friday.

Stocks to enjoy:

DBS Vickers Securities Thailand advises basic stocks that will have upside acquires this quarter such as ADVANC, AOT, CPALL, CHG, AIMIRT and PTTEP.

DBS Vickers sees assistance at 1,500 points and resistance at 1,550. Globlex Securities sees assistance at 1,515 and resistance at 1,550.