Lots of little and medium-sized business, the foundation of Thailand’s economy, are battling with squashing financial obligation loads that might require them out of company as the current wave of Covid infections dims the potential customers for a financial healing.

” This round is much even worse than in 2015, and countless operators are suffering,” stated Sangchai Theerakulwanich, chairman of the Federation of Thai SME, who sent a proposition last month for the federal government to enhance assistance to smaller sized organizations. “If the scenario is extended to the end of the year the country will remain in crisis, with 80% people declaring bankruptcy.”

Thailand’s SMEs, a number of them focused in the tourist market, have actually been struck specifically hard considering that the nation closed its borders in 2015, sending out the economy to its inmost contraction in more than 20 years. The scenario has actually aggravated with everyday cases and deaths at record levels, leading the federal government to enforce fresh constraints in late June.

The Bank of Thailand has actually called consistently to enhance liquidity to SMEs, which are viewed as important to any financial healing. Up until now, however, efforts to funnel billions of dollars of credit at low rate of interest, institute loan-payment vacations and use credit assurances have actually stopped working to breathe life into the sector.

” Credit development to big corporates has actually been growing at over 10% a year. Even for the home sector, credit development has actually likewise been growing at about 4% a year,” reserve bank Guv Sethaput Suthiwartnarueput stated in March. “The sector where credit development has actually been diminishing is the SMEs.”

The nation had 3.1 million little and medium-sized business since in 2015, utilizing 12.7 million individuals, according to federal government information. The Thai Chamber of Commerce thinks the genuine variety of SMEs might be as high as 5 million, considering that lots of smaller sized operators do not sign up with the authorities. The sector represented 35% of the country’s GDP at the end of very first quarter, according to the Workplace of Small and Medium Enterprises Promo.

Body Paint

The reserve bank last month slashed its financial development projection for this year to 1.8%, from 3% formerly, in the middle of weak domestic usage and duplicated cuts to the tourist outlook. Prior to the pandemic tourist contributed about 20% of the nation’s gdp– about double the worldwide average– however the bank now anticipates just 700,000 visitors to get in Thailand this year, below practically 40 million in 2019.

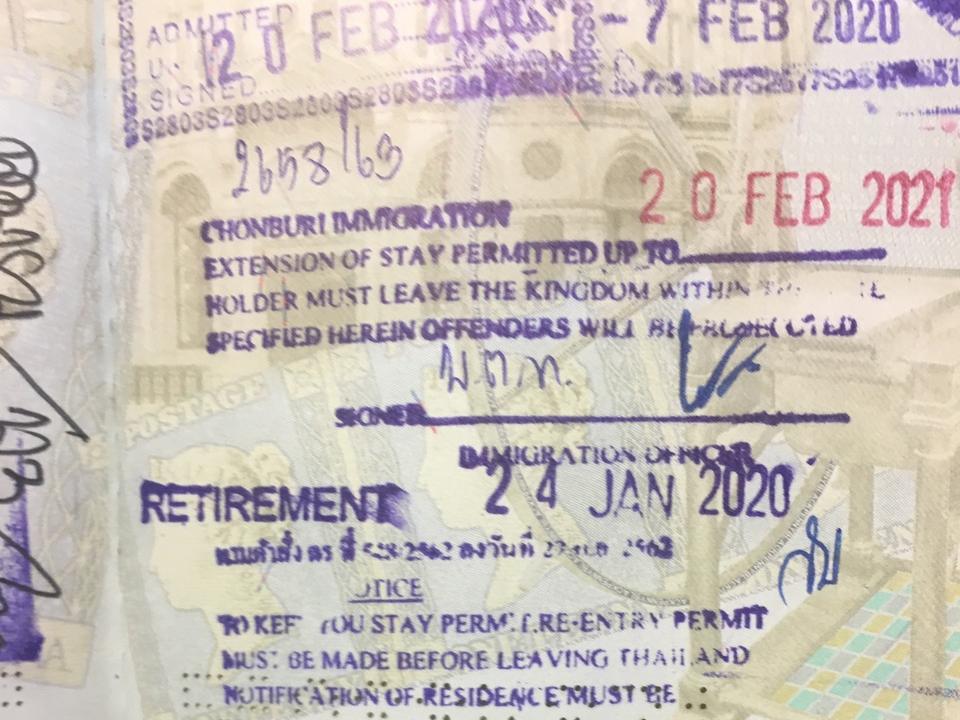

Patcharabhorn Salacheep, 34, who owns a body-painting company dealing with immigrants, shut her Pattaya and Phuket outlets in 2015 as the borders closed and tourist withered. After shedding 70% of her personnel, she still has 3 stores in Bangkok’s Chatuchak weekend market however makes just about 10% of what she utilized to.

She’s seeking to obtain cash to sustain business, however isn’t sure if she’ll be authorized for a bank loan.

” If I do not get it, my company might not endure this year,” Ms Patcharabhorn stated. “The federal government never ever compensated us for what we’re dealing with; what they use are just financial obligation restructuring and loans. They’re pressing us to produce financial obligations while we hardly make earnings.”

Property Storage Facility

The most recent debt-relief steps for SMEs consist of 250 billion baht in low-interest loans for company restructuring and 100 billion baht for an “possession storage facility,” where having a hard time organizations can momentarily park their distressed possessions and get credit in return.

Given that the steps worked in late April, about 24% of the overall reserve for low-interest loans has actually been utilized, and less than 1% of the quantity planned for the asset-warehouse strategy. Bank of Thailand Guv Setaphut stated need for the possession storage facility is anticipated to get later on.

According to the SME federation, bank loans to smaller sized organizations amount to 3.5 trillion baht, consisting of 240 billion baht that are nonperforming. Another 440 billion baht are ranked hardly greater and might turn bad by the end of the year if the economy does not enhance, according to the federation.

More state aid might be quickly coming for little business seeking to update their organizations. The federal government prepares to cover 50% to 80% of the expense of improving efficiency, company management, marketing channels and abroad market advancement to name a few beginning with Oct 1, according to a main declaration Monday.

” Liquidity is not a silver bullet to treat whatever,” stated Naris Sathapholdeja, an economic expert at Bangkok-based TMBThanachart Bank Plc. “Those who’ll get soft loans are those with company potential customers and favorable earnings. If you’re still in the debt-restructuring procedure with banks or can’t create favorable earnings, you’re not likely to get the loans. Banks require to be cautious under the present scenario: Nobody wishes to take on stacks of uncollectable bills once the scenario relieves.”

Mr Sethaput stated not all SMEs will be authorized for the relief steps. Those that ought to are the ones that can endure till the economy begins to recuperate.

” Not all organizations that get loans will endure,” the guv stated. “If we provide what we need to all groups, it might make those that ought to endure stop working too. Whatever has a chance expense.”