For Expats residing in Thailand, it was a helpful early morning at the Pattaya City Expats Club (PCEC) conference on Wednesday, March 1. 2 agents of Company Class Asia used suggestions on matters and plans Expats need to think about to secure their properties with their dreams plainly understood on personality upon their death. After a break for concerns and responses, they then spoke briefly on tax matters that United States and UK Expats need to know.

Lee Stevens, Location Supervisor, and Ken Brown, Wealth Management Professional, started by keeping in mind that their business, Company Class Asia, offers lots of services such as retirement, monetary, estate, & & tax preparation, and other services dealing with Expats residing in Thailand. Lee has actually remained in the monetary market for almost thirty years, having actually operated in the UK for Midland Bank and after that HSBC for 10 years. His knowledge remains in wills and trusts and how they assist UK people to prevent monetary issues when living abroad. Lee formerly spoke with the PCEC in 2019 on the topic of how to prevent monetary and insurance coverage issues by preparing successfully. Ken’s background remains in retirement, financial investment, & & trust preparation, earnings security, and insurance coverage for life, impairment, and important care. He has actually offered lots of discussions around Thailand.

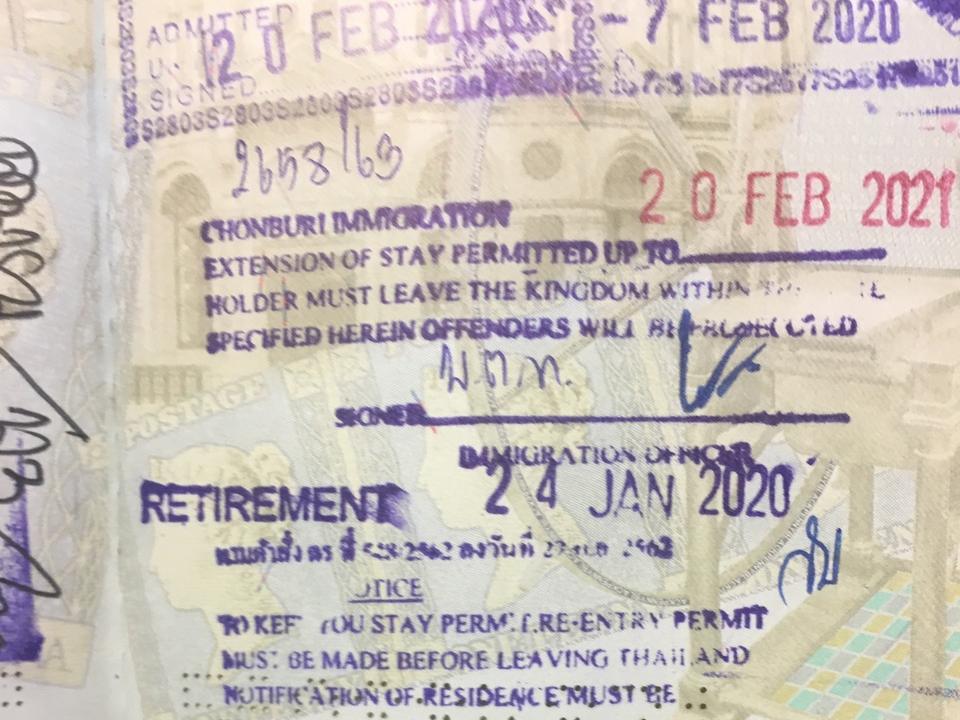

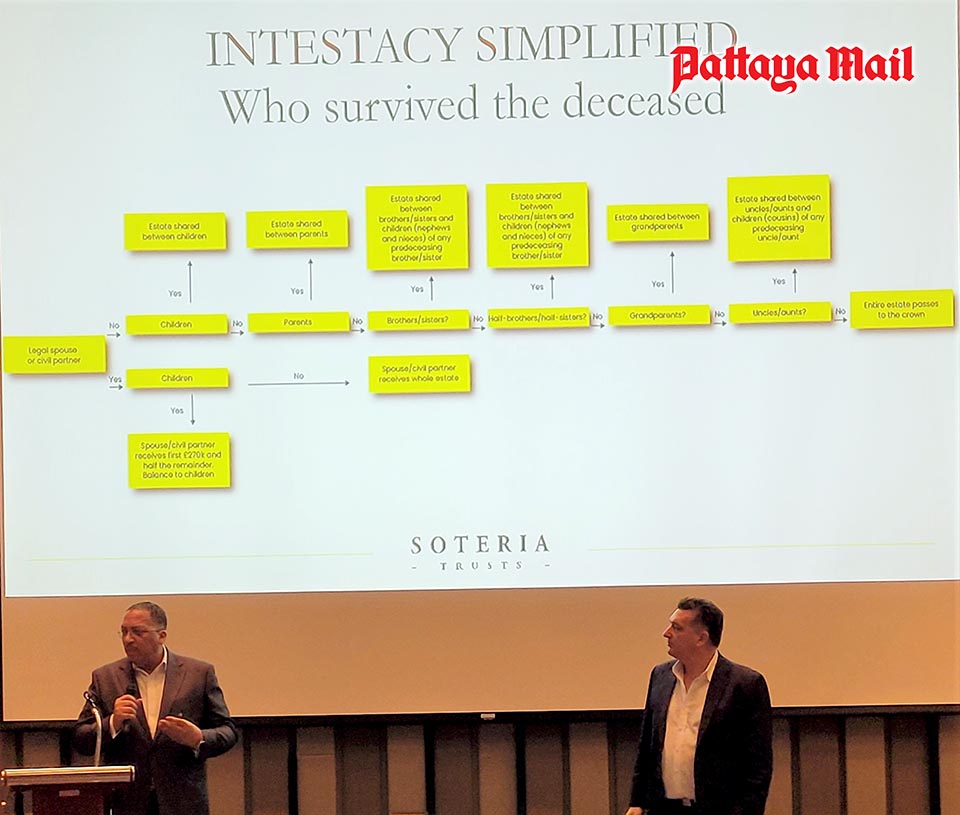

They offered a summary of estate preparation; what it is and why preparation is essential. This was followed with details on Wills; why one need to have one and what occurs if you pass away without. Mainly, one need to have a will to guarantee that their properties go to those they desire and without a will, Thailand, like lots of other nations, has a statutory arrangement setting for who gets one’s properties if they pass away intestate.

They kept in mind the following as being pricey will composing errors and how to prevent them: neglecting properties, being too particular when explaining properties, not correctly catering for stepchildren or senior dependents, not getting ready for what will occur if your recipients pass away prior to you, utilizing a void witness/witnesses, choosing unsuitable administrators, stopping working to upgrade the Will after significant life occasions, and altering a Will after it has actually been signed and experienced.

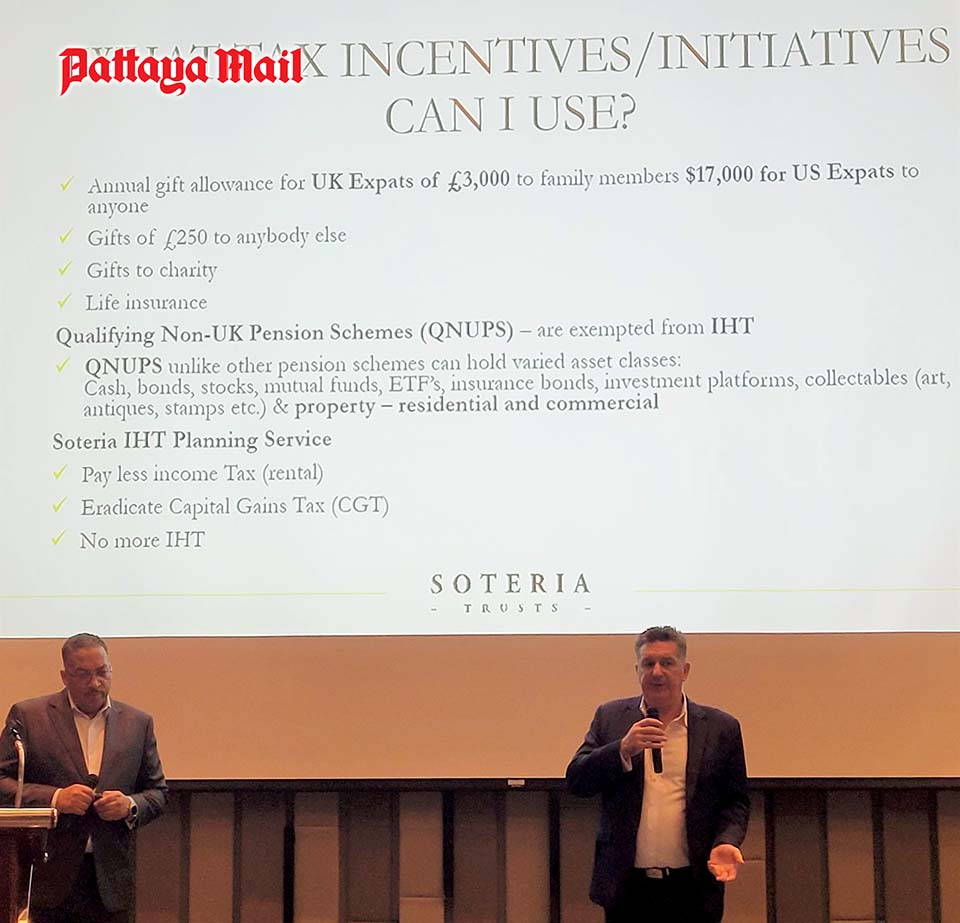

After responding to lots of concerns from the audience, Lee pointed out particular tax rewards offered to UK people. Ken then pointed out some tax problems that United States Expats need to know consisting of the Foreign Account Tax Compliance Act and how its reporting requirements on foreign banks has actually made it typically extremely tough for United States Expats to even open a Thai checking account.

MC Ren Lexander than pointed out some approaching occasions prior to getting in touch with George Wilson to carry out the Open Online forum part of the conference where the audience remark and ask concerns about Expat living in Thailand. To get more information about the PCEC, visit their site at:https://pcec.club To see Lee and Ken’s discussion, check out the PCEC YouTube Channel at: https://www.youtube.com/watch?v=jKphNA3XZ8Y.