Low-rise home need in the upper-end section will continue to be robust next year while condominium market healing will depend upon foreign purchasers, according to SET-listed designer SC Property Corporation Plc.

Chief monetary officer Pradthana Patsaman stated low-rise homes priced 10 million baht and above per system saw high development in the very first half as need had less effect from the financial downturn.

” Property buyers in the upper-end section were likewise more powerful and had more monetary stability to obtain,” she stated. “Our low-rise homes had great sales in all sectors especially pricey systems.”

In the very first half of 2021, it published a brand-new record high of 11.3 billion baht in presales, up 38% year-on-year.

About 83% or 9.4 billion baht originated from low-rise homes, while 17% or 1.95 billion baht originated from apartments.

A crucial motorist of presales from low-rise homes generally credited to single removed homes priced 20 million baht and above per system which saw year-on-year development of 41%, followed by systems priced 10-20 million baht with a boost of 35%.

Profits in the very first 6 months increased 11% to 8.71 billion baht with the biggest share from low-rise homes at 6.82 billion baht.

Net earnings grew 24% to 937 million baht while net earnings margin increased to 10.7% of overall earnings from 9.6%.

It likewise discovered a reduction in the bank rejection rate from low-rise homes to 9.4% in the very first half of 2021 from 14.8% in 2020.

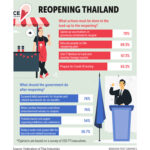

” Apartment market slowed as it presently relies just on regional need,” she stated. “Its healing will depend upon the nation’s resuming which will permit foreign purchasers to come back as they are primary purchasers of apartments.”

Next year SC will release 3 brand-new condominium tasks, among which may be a joint endeavor with Japanese corporation Nishitetsu Group, following the very first joint endeavor condominium, The Crest Park Residences, valued at 3.1 billion baht this month.

” After the pandemic crisis, our development will stabilise with more than 20 billion baht in earnings annually from 2023,” she stated. “We still preserve earnings and presales target of 19 billion baht and 20 billion baht, respectively, by the end of 2021.”

The business prepares to open 3 brand-new hotels in Ratchawat, Ratchadaphisek and Pattaya with an overall of 549 type in 2022, 2023 and 2025, respectively, and anticipates to see net earnings development from repeating earnings at one 3rd by 2023 from 5% this year.

At present, repeating earnings originates from 6 office complex with an overall lettable location of 119,385 square metres with a tenancy of 92%.