WRAP-UP: Worldwide stock exchange lost ground today as financiers examined the effect of more United States rate of interest walkings and stress over Taiwan. External aspects stayed the essential aspects impacting market belief in Asia consisting of Thailand.

The SET index got 4% in August, supported by a strong basic outlook and lower regional bond yields. Regardless of the boost, the SET’s forward price/earnings (PE) ratio just edged as much as 16.7 times, from 16.6.

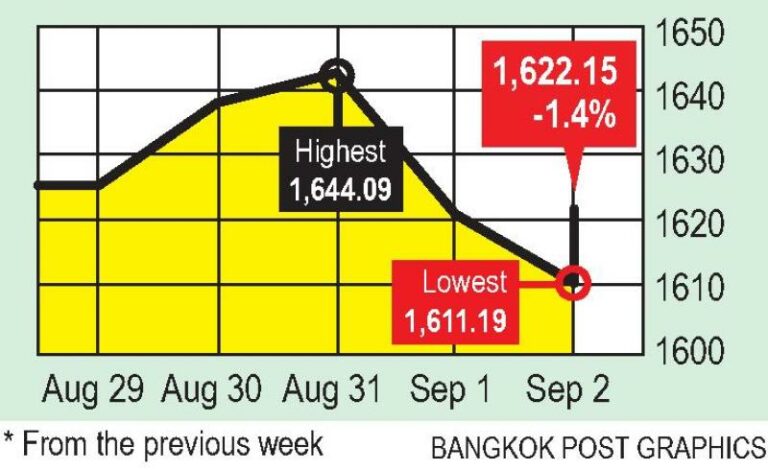

The SET Index relocated a variety of 1,611.19 and 1,644.09 points today prior to closing the other day at 1,622.15, down 1.4% from the previous week, in typical day-to-day turnover of 70.56 billion baht.

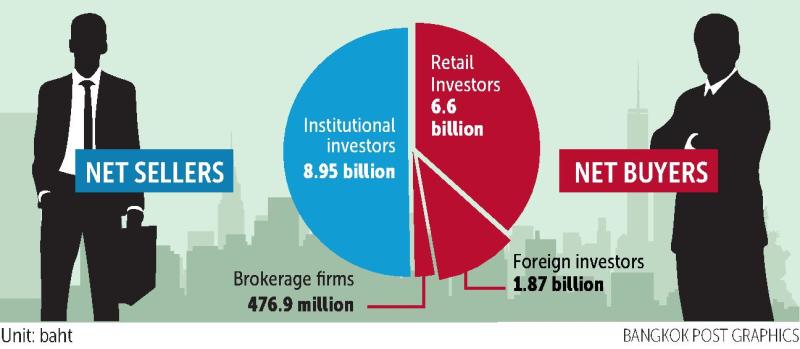

Retail financiers were net purchasers of 6.6 billion baht, followed by foreign financiers at 1.87 billion and brokers at 476.9 million. Regional institutional financiers were net sellers of 8.95 billion baht.

NEWSMAKERS: Lenders of Thai Airways International on Thursday authorized a modified organization rehab strategy. The provider informed the SET that lenders holding 78.59% of its overall financial obligation backed the strategy, which will be sent to the Central Insolvency Court on Sept 14.

-

.(* )The Japanese yen fell previous 140 to the dollar for the very first time given that 1998, even more checking the Bank of Japan’s resistance to the international wave of interest-rate boosts, even as inflation presses past the reserve bank’s 2% target.

- .(* )The Philippine peso sank to an all-time low near 57 to the United States dollar, including pressure on the reserve bank to raise rates more strongly. With a 10% loss this year, the currency is the 3rd worst entertainer in Asia after the yen and the won.

- .

- .

- .

- .(* )The Bank of Thailand prepares to hold a brand-new financial obligation mediation occasion in an effort to reduce swelling home financial obligation and assistance susceptible customers restructure liabilities in the middle of the irregular healing. Amongst financial obligations amounting to 14.6 trillion baht, the greatest issue is unsecured loans such as charge card and individual loans, which represent 23% of the overall.

- Asia Plus Securities anticipates both the United States and Thailand to report high August inflation. It approximates an 8.9% increase in United States customer rates, which would trigger the Federal Reserve to raise its essential rate by 75 basis points. Thailand is anticipated to report an 8.6% dive, up from 7.6% in July, which would lead the BoT to raise its rate by 25 basis points at each of its next 2 conferences.

- Live chicken rates in Thailand have actually struck a 10-year high of 49 baht a kilogramme, driven by increasing meat need and a rebound in financial activity. Furthermore, Saudi Arabia has actually allowed imports of chicken items from 11 factories in Thailand, consisting of 6 run by Charoen Pokphand Food (CPF) one by GFPT Plc.

- CP Group is putting a non-binding quote of around 80 billion rupees (36.8 billion baht) for the Indian operations of City Money and Carry, according to a report by The Economic Times. Dependence Retail has actually likewise tried reported to be around 56 billion rupees.

- Innobic (Asia) Co, the life sciences arm of the oil and gas corporation PTT Plc, is looking for a brand-new organization partner in Iceland to produce medications to deal with cancer.

- MAI-listed Bluebik Group, a digital improvement company, intends to develop an international existence by diversifying to cybersecurity, blockchain and metaverse offerings. The company states it anticipates to dedicate numerous hundred million baht to mergers and acquisitions (M&A) and joint endeavors over the next 5 years.

- Thai exports slowed in July from June, due generally to lower need in line with a dangerous international economy. The United States dollar worth of product exports, leaving out gold and after seasonal modification, fell 2.7% from the previous month however grew 3.8% year-on-year, the Bank of Thailand stated. Annualised development, nevertheless, was below 10.7% development in June.

- .

- .

- .

- .

- .(* )PTT Plc is preparing to introduce Thailand’s very first hydrogen filling station next month in Pattaya to serve trucks and buses. The 10-million-baht center is a cooperative endeavor with Toyota Motor Corp and Bangkok Industrial Gas (BIG), Thailand’s biggest commercial gas manufacturer.

- SHOWING UP:

- .

.(* )Oil rates rallied the other day, paring a substantial weekly decrease, ahead of an Opec+ conference on Monday at which Saudi Arabia is anticipated to promote output cuts to restore rates.

Bitcoin sneaked back above $20,000 the other day after another unpredictable week, as belief in the cryptocurrency market stayed weak. The sector has actually contracted to less than $1 trillion, about a 3rd of its all-time market price reached in November.

Around 16 million individuals in the Chinese city of Chengdu were locked down on Thursday as authorities raced to off a brand-new Covid break out. China is the last significant economy wedded to a zero-Covid policy, however at a high financial expense.

Bankrupt Sri Lanka on Thursday consented to a conditional $2.9-billion bailout with the International Monetary Fund. The federal government invited the statement however alerted the general public that agonizing financial reforms were still needed.

.

.

.

.

.

.

.(* )Pig farmers are getting in touch with authorities to do more to take on pork smuggling. The Swine Raisers Association of Thailand states smuggled pork is now offered in the market at a much selling for 130-150 baht per kg in regional markets, compared to 190-200 baht for in your area produced pork.

Real Corporation has actually participated in an unique collaboration contract with the South Korean metaverse platform Zepeto to reinforce its digital community of telecoms, material and e-commerce. Zepeto, run by South Korea-based Naver Z Corp, has more than 340 million users worldwide.

Thailand’s fuel usage for the very first 7 months grew 13.5% year-on-year for all types other than kerosene. Fuel usage in the transportation, commercial and home sectors increased to 151 million litres daily as financial activity got and Covid-linked travel curbs relieved.

Kasikornbank is partnering with the e-wallet company T2P Co to broaden services to business consumers. Beacon, the bank’s equity capital arm, has actually made a tactical financial investment in T2P to collectively establish an e-wallet organization under business to organization to customer (B2B2C) design.

Thaicom is getting in touch with the telecom regulator to change draft conditions for the auction of satellite orbital slots as it states reserve rates are still too expensive and location excessive of a concern on operators.

.

On Sept 5, China’s Providers Buying Managers’ Index (PMI) of Aug will be reported, followed by the EU Production and Solutions Index of the very same month, together with July retail sales. On Sept 6, the United States Institute of Supply Management (ISM) will report PMI and producing PMI and service PMI for August. Sept 20-21, the United States’ Federal Reserve (Fed) conference.

.(* )For domestic occasions: Sept 5, the Commerce Ministry will report Aug inflation. Sept 6, the cabinet is anticipated to think about the tripartite committee’s proposition to raise a base pay, while the Council of Exporters launches export updates. On Sept 28, the Monetary Policy Committee (MPC) satisfies on rate of interest.

STOCKS TO VIEW:

Finansia Syrus Securities (FSS) states market volatility will press tech and development stocks, in addition to those with high price/earnings ratios that have actually surpassed the marketplace in the previous 2 years. Though some have actually pulled away substantially currently, these stocks are anticipated to have actually restricted healing capacity. As a result, it advises concentrating on stocks connected to financial resuming, usage and tourist, such as CENTEL, CPN, SC and SISB. .

Other outperformers suggested by FSS are TFG, M and TU, while banks need to surpass if the BoT treks its policy rate by another 25 basis points at its Area 28 conference.

-

.

- Capital Nomura Securities advises recipients of the weaker baht in the food and drink group such as CPF, GFPT, TU, ASIAN, TFG, SAPPE and ICHI; and stocks connected to domestic need such as ADVANC, TIDLOR, INTUCH, DTAC, CPALL, MAKRO, CRC, HMPRO, ILM, KTC, SNNP, BEC and ONEE.

.(* )For mid- to long-lasting financial investment, the broker advises building up SCGP, GPSC, BGRIM, CBG, SCC, TOA, EPG, GULF and SAPPE. High-growth choices are JMT, VOCALIST, CHAYO, BE8, BBIK and IIG.

.

TECHNICAL VIEW:

- Thanachart Securities sees assistance at 1,600 points and resistance at 1,640. Capital Nomura sees assistance of 1,604 and resistance at 1,635.