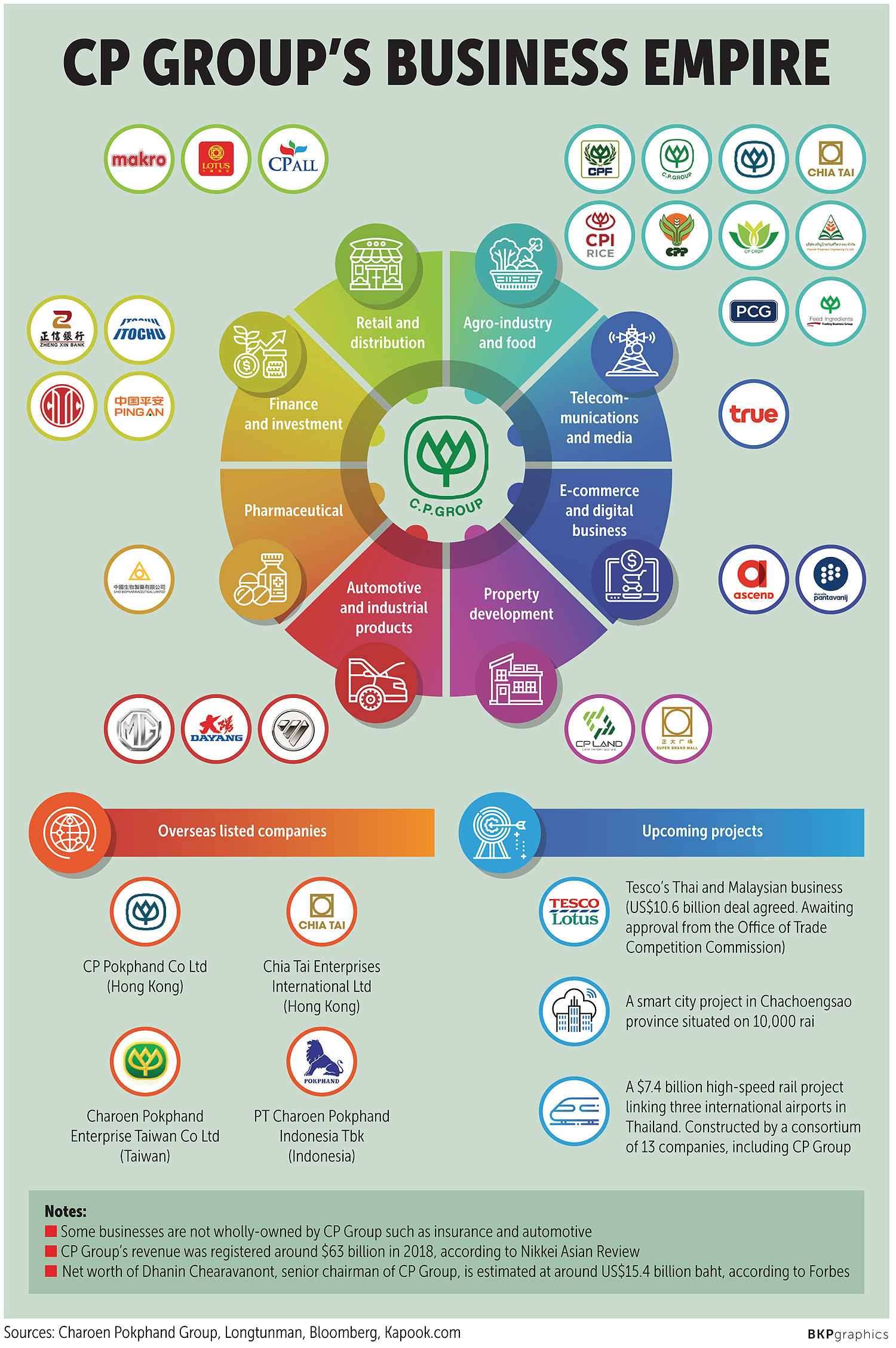

From every-corner corner store and farming seeds to unnoticeable cordless networks and a prepared high-speed train, business empire of Charoen Pokphand (CP) Group appears to extend beyond the sky’s limitation, without any holds disallowed for its enhancing size.

With the corporation thriving over other bidders for control of UK-based Tesco’s Asia organization in an offer worth US$ 10.6 billion, CP Group’s grip on managing significant stakes in Thailand’s organization landscape appears firmer, introducing a breathtaking and scary sense at the exact same time.

Consisted of in the offer are 200 Tesco Lotus hypermarkets and 1,600 Tesco Lotus Express corner store in Thailand and 74 outlets in Malaysia, Reuters reported.

The offer will likewise be a test for Thailand’s anti-trust authority, the Workplace of Trade Competitors Commission (OTCC), regarding whether the acquisition would be thought about a monopoly, considered that CP currently owns 7-Eleven corner store and the Makro cash-and-carry organization.

Under the 2017 law, proposed mergers that might cause market supremacy or a monopoly should be evaluated by the OTCC. Supremacy is specified as having a market share of over 50%, or 75% when integrated with 2 peers.

CP Group formed the Lotus Supercenter chain in 1994 under billionaire Dhanin Chearavanont’s management.

However after the baht collapsed in July 1997 and set off a broader monetary crisis in Southeast Asia and beyond, the group offered 75% of Lotus to Tesco the list below year, Nikkei Asian Evaluation reported. The rest was offered in 2003.

” It [Tesco Lotus] is really my kid,” Mr Dhanin stated throughout an interview with regional media. “I am purchasing it back with a belief that I can raise this kid much better with brand-new strategies and innovations.”

FOCUSED WEALTH

The Tesco offer need to be a wake-up call for the federal government to take a look at the pushing problem of “financial lease” and the control of big capitalists or organization magnates, who control the marketplace and hold extreme market share, providing a benefit in competitors, bargaining power and item cost control, at the expense of the marketplace.

In the past, the federal government has actually constantly promoted capitalists in their financial investments, stated a high-ranking scholastic authorities.

When it comes to Tesco’s Asia organization takeover by CP Group, the offer is not likely to cause a monopoly, because there is still competitors for each organization. It is just that the takeover will increase CP’s bargaining power and control over the marketplace.

As the corporation spreads its wings in the marketplace, providers are most likely to be under more pressure as they stay forced to offer to CP since of Tesco’s high market share, although margin is low. As an outcome, customers will need to pay more out of their pockets as items end up being more costly, the authorities stated.

The issue in Thailand is that magnates have power in the nation and usage connections and cash to get earnings from the lower class, whether in residential or commercial property or the retail sector.

” As an effect, the abundant ended up being richer and the bad continue to stay bad,” the authorities stated.

The issue is intensified by fast-growing wealth at the top amongst Thai billionaires and the burrowing of the middle class due to slow-growing earnings and high family financial obligation.

A couple of households manage half of the economy in Thailand, and their power is frustrating in regards to control of item list prices and competitors, the authorities stated.

A Tesco Lotus hypermarket branch in Bangkok. CP Group clinched a US$ 10.6-billion offer for Tesco Asia’s organization, based on regulative approval. Panupong Changchai

PROVIDER ISSUES

According to Pavida Pananond, an associate teacher in the Department of International Company, Logistics and Transportation at Thammasat University, providers are most likely to bear the force of CP Group’s debt consolidation of the retail market.

” I believe it is not likely CP would raise costs significantly on customers, however would be most likely to look for lease from its providers that have no option however to offer to CP,” Assoc Prof Pavida stated. “It would be challenging to increase costs for customers since CP still deals with stiff competitors from Cancer and other warehouse store, where the individuality of the experience is the low cost.”

As CP manages the entire vertical supply chain, for example in shrimp and chicken, this makes it difficult for any organization to contend. Its broad horizontal combination indicates that any foodstuff provider in the nation has practically no option however to offer to CP, no matter the margins.

” CP can copy items from its independent providers under its own home brand name and after that offers its own top quality products much better positioning in shops and lower costs,” Assoc Prof Pavida stated. “If some items end up being popular, like bathroom tissue, then CP might generate its own home brand name and location it more positively.”

CP All, a CP Group subsidiary that runs all 7-Eleven shops in Thailand, triggered a social networks outcry in 2015 after it brought out a comparable item to the Tokyo Banana treat, drawing allegations that it was bullying smaller sized brand names.

Assoc Prof Pavida anticipates the Tesco acquisition offer to end up being the very first test for the recently independent OTCC, to see if the organisation depends on the job of handling big business interests in Thailand. Formerly, the workplace became part of the Commerce Ministry and vulnerable to political pressure.

” This offer might have crucial repercussions for Thailand’s organization environment and foreign direct financial investment,” she stated. “We are now seeing big business like CP and ThaiBev managing much of the markets, and as this is viewed to be typical practice for organization in Thailand, it might weaken competitors for foreign companies thinking about purchasing the nation.”

” It is possible that the OTCC will authorize the offer if the commission examines there is a difference in between retail and wholesale companies,” stated Kitipong Urapeepatanapong, chairman of Baker & & McKenzie’s Bangkok workplace.

Mr Kitipong indicates the case of the Siam Makro acquisition by CP All in 2003. An anti-trust claims was shot down based upon the reasoning that the 2 companies run in a various landscape.

Dhanin Chearavanont, senior chairman, CP Group at an interview. SEKSAN ROJJANAMETAKUN

INCREASING INEQUALITY

Ranked in the leading area in the Forbes Thailand Rich list with $29.5 billion in 2019, the Chearavanont household is viewed as one of the effective clans with huge monetary power– however at the cost of the social material, especially in regards to inequality.

Customers and providers might not feel the pinch of CP Group’s Tesco deal today, however social inequality and Thailand’s wealth space will undoubtedly get worse as industries continue to get bigger stakes in every domestic market, stated independent scholastic Somjai Phagaphasvivat.

” The space in between the abundant and the bad will broaden,” Mr Somjai stated. “Every Thai federal government is the exact same. They have actually not had the ability to withstand the monetary power of industries and have actually even developed comfy ties with them.”

Federal governments have actually likewise stopped working again and again to establish a law to avoid significant corporations from entering the area of regional small companies, he stated.

The Gini Coefficient index, a widely accepted requirement that is likewise utilized by the World Bank to determine inequality amongst nations worldwide– concentrating on 2 essential elements, earnings and expense– is a sign showing Thailand’s expanding social inequality.

A greater Gini index shows higher inequality, with high-income people getting a much bigger portion of the overall earnings of the population.

The Gini index worth for Thailand was 36.50, a medium level of inequality, since 2017.

Thailand likewise dismissed Russia and India as the most unequal nation, according to the findings of the Credit Suisse International Wealth Databook 2018 performed on 40 nations.

LAND CONTROL

Getting control of Tesco Lotus superstores in Thailand can likewise assist CP Land Plc, a residential or commercial property arm of CP Group, increase the capacity of uninhabited land near Tesco Lotus branches in significant provinces.

Among the highlighted land plots is a 30-rai piece in South Pattaya, situated near Tesco Lotus South Pattaya on Sukhumvit Roadway.

” With CP Group’s clinching of the Tesco quote, this plot will have greater possible since it lies behind that Tesco branch, which is on the primary roadway,” stated a source near CP Land. “Then the group’s residential or commercial property advancement strategy in Pattaya to capitalise on its high-speed train task will end up being much more appealing.”

Besides the South Pattaya plot, CP Land has 2 other big plots of uninhabited land near Tesco Lotus for future advancement, consisting of over 60 rai in Nakhon Si Thammarat and 20 rai in Khon Kaen.

Both plots are likewise next door to CP Land’s hotel and workplace tower in those provinces. In Khon Kaen, the company likewise has a convention and exhibit centre.

CP Land, which was established in 1988, began with the advancement of office complex CP Tower 1 on Silom Roadway, then branched off to provinces in 1997, beginning with Khon Kaen as the very first location.

” Purchasing a big plot of land in provinces and dividing some parts for residential or commercial property advancement, such as retail, workplace, hotel and house, can match one another and increase the worth of the plot,” the source stated.

For instance, after the group got land plots of over 60 rai on Mitraphab Roadway in Muang district of Khon Kaen, Tesco Lotus established Tesco Lotus Khonkaen and CP Group set up an office complex, CP Tower Khon Kaen 1, on that plot in 1998.

The essential male behind effective land purchases and residential or commercial property advancement in Khon Kaen was Sunthorn Arunanondchai, president of CP Land and vice-chairman of CP Group. He likewise developed the joint endeavor in between CP Group and Tesco in 1998.

” Mr Sunthorn is an essential male who looked for and purchased land plots in possible places with excellent costs for Tesco Lotus branches in provinces,” the source stated. “If possible, getting a big land plot is the very best offer.”

Mr Sunthorn, who has some stakes in CP Land, as soon as stated that the advancement of workplaces, hotels or apartments in provinces might decrease the group’s expenses, as its middle- to upper-level personnel working for Tesco Lotus and 7-Eleven across the country might lease or purchase apartments under CP Land’s advancement.

When personnel or executives from head offices have organization journeys in provinces, they can remain at the hotels or utilize the workplace towers for organization conferences.

Consumers purchase groceries at Tesco Lotus Sukhumvit 50. Getting control of Tesco Lotus hypermarkets in Thailand can assist CP Group’s involved companies.

‘ ANYTHING CAN HAPPEN’

A magnate at a leading oral care producer, speaking on condition of privacy, stated CP Group’s viewed market supremacy is not such an issue, as long as the executive’s business continues dealing with both 7-Eleven and Makro, which are expertly run and work individually.

” I do not anticipate much issue as long as they are run expertly and individually,” the executive stated. “However the issue might take place if CP Group swimming pools its purchases for the whole retail systems.”

Another source from a home items producer stated that after Tesco operations are under CP Group’s umbrella, all providers anticipate more troubles in working.

This source still hopes that the Commerce Ministry will impose the Trade Competitors Act seriously to secure providers and customers.

On the other hand, a source from a significant durable goods company stated that the offer, as soon as finished, will enthrone CP Group as the dominant force in the retail market.

This is since the group’s retail companies cover not simply corner store, however likewise grocery stores, hypermarkets and wholesalers.

” Anything can take place as soon as CP takes control of all circulation channels,” the source stated. “The group will get a lot more bargaining power over providers.

” This organization offer need to not take place from the beginning, as customers might not have any options. If it [CP Group] pressures me to make a greater revenue, the extra expense will definitely hand down to clients.”